- A6001C17 Advances in Animal Production Science Assignment Brief 2026 | HAU

- SOCI5270 Contemporary Sociological Theory Essay Assessment 2026 | UOK

- 4BE002 The Innovative Business Assignment Brief 2026 | University of Wolverhampton

- CIPD Level 5 5LD01 Support Informal and Self-Directed Learning Assessment Brief 2026

- COM4016 Productivity and Collaboration Tools for Learning and Work Assessment Brief 2026 | Arden University

- CA6060 Financial Decision-Making in Context for Aviation Assignment 2 Question 2026

- NCFE CACHE Level 3 Diploma for Working in the Early Years Sector Assessment Brief 2026

- CRN 63466 / CRN 63467 Statutory Valuation Level 7 Assessment Brief 2026 | USM

- BSM24105 Operations and Project Management Assessment Brief 2026 | RUL

- Professional Communication Assessment 1 Semester 2, 2026 | UGM

- LAW7128 Conflict Resolution in Business Assignment Brief 2026 | BCU

- MLA604 Maritime Operations Assessment Brief Jan 2026 | MLA College

- HS7008 Research Methods in Public Health Summative Assignment 2026 | UEL

- MAR020-1 Introduction to Digital Marketing and Analytics Assignment 1 Brief 2026 | UOB

- LCBB5014 Data Handling and Business Intelligence Assignment Brief 2026 | UOW

- 6BM040 Honours Research Project Assessment Brief 2026 | University of Wolverhampton

- A334 English Literature from Shakespeare to Austen Tutor-Marked Assignment 03, 2026 | OU

- ADV767 Advanced Clinical Reasoning in Musculoskeletal Conditions Assessment Brief 2026 | UOP

- IS2184 Information Systems Management Individual Assignment 2026 | UOL

- MK7050 Principles and Practices of International Business Assessment Brief 2026

Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business: Accounting and Finance Assignment, DMU, UK

| University | De Montfort University (DMU) |

| Subject | Accounting and Finance |

Assessment Brief

This multitasks written assessment has THREE tasks relating to management accounting and the use of management information for decision making. The objectives are:

- To test your understanding of the management accounting function.

- To test your knowledge of key management accounting concepts and processes.

- To test your ability to analyze and interpret financial information and use them to make appropriate business decisions.

This is a pre-seen open book assessment, and you may complete it in your own time, at any point up to the submission deadline indicated below.

Task 1

- Briefly differentiate between Direct Costs and Indirect costs in total Product Cost determination in business. Give examples if possible

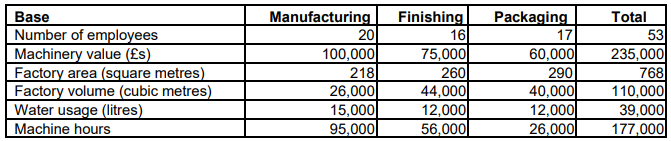

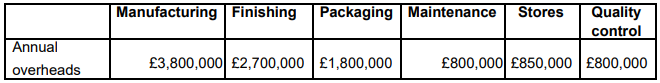

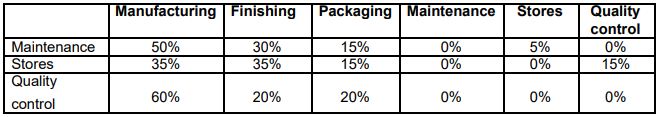

- DKM Leicester Limited manufactures Student metal beds in three production departments in their Leicester production hub: Departments are Manufacturing, Finishing, and Packaging. DKM Leicester Limited also has three service departments, namely: Quality Control, Stores, and Maintenance. The company uses an absorption costing system to analyze product costs, and you have been supplied with the following information in relation to the production departments as indicated in Table 1 below:

- DKM Leicester Limited estimates to spend £120,000 for heating the factory during the year 2022 financial year, calculate the heating cost that should be allocated to each of the three production departments.

Task 2

DKM Leicester Limited also produces special ergonomic student tables in one of their production hubs located in Manchester. The forecasts for the year 2022 are that fixed costs will be £22,000,000, variable costs per student table will be £600, and sales price will be £770 per Student table. Sales for the year are forecasted at 850,000 Student tables.

- How many Student tables will have to be produced and sold to break even in the Manchester production hub?

- Calculate the company’s margin of safety as a percentage of sales.

- The Managing Director of the Manchester production facility has declared that the profit target for the year 2022 is to be £90,000,000. How many Student tables does the facility need to make and sell to achieve that target profit?

- The Directors of DKM Leicester Limited were advised by the company’s external accountant that for the company to be successful, they have to produce beyond the breakeven point. However, the directors do not understand what the accountant meant by the term ‘Break Even Point’. Provide a brief note for the directors that explains what the ‘Break Even Point’ means.

Task 3

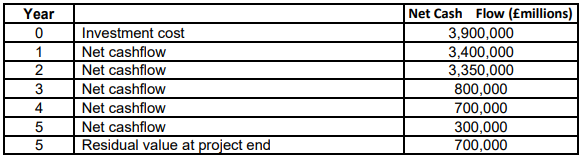

The directors of DKM Leicester Limited are considering investing in producing a Student Covid-19 vaccine testing kit to tackle the new Omicron variant in the UK. The project is estimated to have the following cash flows in the five (5) year period, and the company has the required rate of return at 18%.

- What is the payback period for the project?

- Calculate the Accounting Rate of Return for the project

- Calculate the Net Present Value of the project.

- Based on the NPV calculation, advise the directors of DKM Leicester Limited whether or not they should undertake the project?

- List four advantages of the NPV investment appraisal technique.

Are You Looking for Answer of This Assignment or Essay

UK Assignment Help is the top university assignment help online in the UK. our experienced writers have vast experience to offer fresh and original answers related to finance and accounting assignment at a market price.