- Unit 6: Website Development Pearson BTEC Level 3 National Extended Certificate in Information Technology Assignment, UK

- TQUK Level 4 Certificate in Higher Level Teaching Assistant (RQF) Assessment Task Unit 3 , Assignment, UK

- Describe the different forms that energy can take: radiography Assignment, UOL, UK

- Explain the difference between velocity and acceleration. You must include suitable drawings: radiography Assignment, UOL, UK

- CP70042E: Write an essay to explore the network attacks and new access control challenges: Network and System Security (Level 7) Assignment, UWL, UK

- Critically analyse one competitor website / blog and use of content and social media: Digital marketing Assignment, UOS, UK

- 5ENT2044: A group-based but individually submitted project incorporating a survey based on the Level 5 field course: civil engineering Assignment, UK

- Analyse how statutory frameworks underpin service provision: Level 4 in Lead practitioner in Adult Care Assignment, UK

- “Expansionary fiscal policies stimulate private consumption and investments”: explain and discuss: Macroeconomics Assignment, UNIS, UK

- Prepare a project time plan to develop the software program: Engineering unit 35 Assignment, UK

- ‘Fostering employee wellbeing is good for people and the organization’. CIPD (2022) Drawing upon published research: CIPD Level 7 Assignment, UK

- Officers are concerned the reptiles could have been a source of contamination of the food: Food control and hygiene management Assignment, UOEL, UK

- Develop a SWOT analysis of the current situation at AlphaCo: Operations and Information Management Assignment, UOS, Uk

- Your company produces radio transmitters and part of that circuit multiplies a high frequency sinusoidal carrier: engineering Assignment, TUOS, Uk

- The diagram shows a DC resistor network. The network is supplied by a 12 V battery: Unit 57 – Electrical and Electronic Principles Assignment, UK

- An engineer has completed two tests on two conductors: Unit 57 – Electrical and Electronic Principles Assignment, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work,

- Sea Dolphin Ltd entered into a contract with Marine Adventure Shipping Ltd for the carriage of 5 tonnes of frozen fish: International Commercial Law Assignment, CUL, Uk

- 1.1 Explain what is meant by: personal wellbeing, self-care, resilience: Health and Social care Assignment, UOG, UK

- Explain the purpose and principles of independent advocacy: Health and Social care Assignment, UOG, UK

Mr and Mrs Netyu run a private company, Netyu Toys Ltd. Toys are imported from China: Financial Accounting Assignment, UOL, UK

| University | University of London (UOL) |

| Subject | Financial Accounting Assignment |

Question 1

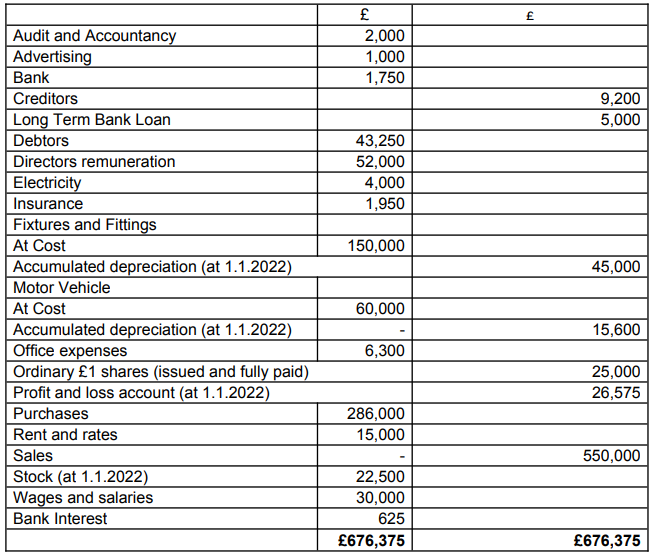

Mr and Mrs Netyu run a private company, Netyu Toys Ltd. Toys are imported from China. Mr Netyu has asked you to prepare set of financial statements for the year ended 31 December 2022 as soon as possible. The company’s accountant had to take time off due to health issues. The following balances have been extracted from the records of the company for the year ended 31 December 2022.

Do You Need Assignment of This Question

1. 2. Stock at 31st December 2022 valued at cost amounted to £22,500.

3. Depreciation is to be provided on fixtures and fittings at 15% on cost, and

at 20% on reducing balance method for motor vehicle.

4. Provision is to be made for rent and rates for £1725.

5. Insurance paid in advance at 31st December 2022 was £500.

Required

1. Prepare Income statement for the year ended 31st December 2022

(10Marks)

2. Prepare Balance Sheet as at 31st December 2022. (15

Marks)

3. Identify FIVE accounting concepts that have been applied in the

preparation of financial Statements and explain their meaning.

Buy Answer of This Assessment & Raise Your Grades

Looking for top-notch Finance Assignment Help UK? Look no further! Our platform specializes in offering Assignment Help UK to University of London (UOL) students. Specifically catering to the intricacies of Financial Accounting assignments, we assist students like you in comprehending complex topics.

Whether it’s analyzing cases like Mr and Mrs Netyu’s business, Netyu Toys Ltd., importing toys from China, or any other challenging subject matter, our experts are here to provide comprehensive guidance. Pay our experts for reliable assistance and excel in your coursework stress-free!