- Lead Adult Care Worker Level 3 Safeguarding Assessment | Salford City College

- K/650/1144 Professional Development and Academic Writing Skills Assessment

- M26753 Mechanical Principles Assignment Brief | University Centre IOW

- Care Safeguiding Children Assignment | Oxford Brookes University

- PSY4011 Developmental Psychology Assessment Brief | Arden University

- QSP7PCM Professional Cost Management Assignment 2 September 2025 | UCEM

- EGR2006M Control Systems Assignment 1 Brief | University of Lincoln

- MBA7066 Innovation and Entreprenuership Assignment Portfolio 2025 | UGM

- Contract Law Assessment 2 Problem Scenario 2025-26 | University Of Salford

- Operations & Supply Chain Management Assignment Brief : E-Commerce Supply Chain Efficiency

- Unit 1 Programming Assignment 2025-26 | ESOFT Metro Campus

- K/651/4745 Unit 1 Teaching My Subject Written Assignment | Britannia Education Group

- H/650/1099 Level 4 Academic Writing and Research Skills Assignment Brief | LSBU

- ASB-4012 Codding for Business Application Assignment – Project in R | Bangor University

- Unit: Team Management in Health and Social Care OTHM Level 5 Diploma Assignment

- BTEC Level 3 Unit 4 Programming Assignment – Concepts of Programming

- HSO4004 Principles of Care Assignment-1 and Assignment-2 Semester-1 September 2025-26

- 1031ENG-N Civil Engineering Construction Technology In-Course Assessment (ICA) Group Report | Teesside University (TU)

- MOD009382 Finance and Governance in Health and Social Care 011 Assessment Coursework Report | Anglia Ruskin University

- Geotechnical Engineering Assignment 2025/26 – University Of Surrey (UniS)

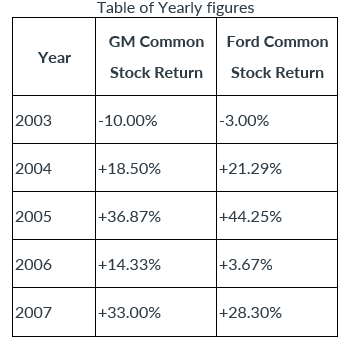

In the New York Stock Exchange (NYSE), the common stocks of General Motors (GM) and Ford (F) are recorded historically below: business management Assignment, UO, UK

| University | University of Oxford (UO) |

| Subject | Business Management |

Financial Insights and Business Intelligence

In the New York Stock Exchange (NYSE), the common stocks of General Motors (GM) and Ford (F) are recorded historically below.

Required tasks in 1500 words using the table of the yearly figure above:

As a capital-budgeting manager at NYSE, you are required to calculate the following task for advising your client:

- Estimate the average rate of return of each stock individually.

- If your client invested in a stock portfolio comprising 40% of GM common stocks and 60% of Ford common stocks, what would have been the rate of return on the asset portfolio each year?

- What would have been the average return on the portfolio during the period from 2003 to 2007?

- Estimate the (individual) risk of each stock.

- Calculate the risk for the asset portfolio (both common stocks taken together).

- What is the coefficient correlation between the returns of the two common stocks?

- Critically discuss the modern portfolio theory, which was pioneered by Harry Markowitz, in relation to your findings and advise your client accordingly in layman’s terms on the profitability of your client’s asset portfolio.

Are You Looking for Answer of This Assignment or Essay

Seeking for assignment help for UK students? Our tailored services cater to the University of Oxford (UO) with specialized Online Business Assignment Help for Business Management tasks. Specifically, we analyze historical records of General Motors (GM) and Ford (F) common stocks in the New York Stock Exchange (NYSE). UK students can trust our expertise, paying for expert guidance to excel in their coursework at UO effortlessly.