- Describe the different forms that energy can take: radiography Assignment, UOL, UK

- Explain the difference between velocity and acceleration. You must include suitable drawings: radiography Assignment, UOL, UK

- CP70042E: Write an essay to explore the network attacks and new access control challenges: Network and System Security (Level 7) Assignment, UWL, UK

- Critically analyse one competitor website / blog and use of content and social media: Digital marketing Assignment, UOS, UK

- 5ENT2044: A group-based but individually submitted project incorporating a survey based on the Level 5 field course: civil engineering Assignment, UK

- Analyse how statutory frameworks underpin service provision: Level 4 in Lead practitioner in Adult Care Assignment, UK

- “Expansionary fiscal policies stimulate private consumption and investments”: explain and discuss: Macroeconomics Assignment, UNIS, UK

- Prepare a project time plan to develop the software program: Engineering unit 35 Assignment, UK

- ‘Fostering employee wellbeing is good for people and the organization’. CIPD (2022) Drawing upon published research: CIPD Level 7 Assignment, UK

- Officers are concerned the reptiles could have been a source of contamination of the food: Food control and hygiene management Assignment, UOEL, UK

- Develop a SWOT analysis of the current situation at AlphaCo: Operations and Information Management Assignment, UOS, Uk

- Your company produces radio transmitters and part of that circuit multiplies a high frequency sinusoidal carrier: engineering Assignment, TUOS, Uk

- The diagram shows a DC resistor network. The network is supplied by a 12 V battery: Unit 57 – Electrical and Electronic Principles Assignment, UK

- An engineer has completed two tests on two conductors: Unit 57 – Electrical and Electronic Principles Assignment, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work,

- Sea Dolphin Ltd entered into a contract with Marine Adventure Shipping Ltd for the carriage of 5 tonnes of frozen fish: International Commercial Law Assignment, CUL, Uk

- 1.1 Explain what is meant by: personal wellbeing, self-care, resilience: Health and Social care Assignment, UOG, UK

- Explain the purpose and principles of independent advocacy: Health and Social care Assignment, UOG, UK

- Demonstrate a range of effective communication styles, methods and skills: Health and Social care Assignment, UOG, UK

- Describe the range of communication styles, methods, and skills available: Health and Social care Assignment, UOG, UK

FIN6003 Delta Ltd wishes to calculate its current cost of capital for use as a discount rate in investment appraisal: Financial Management Assignment, AU, UK

| University | Arden University (AU) |

| Subject | FIN6003 Financial Management Assignment |

Question 3

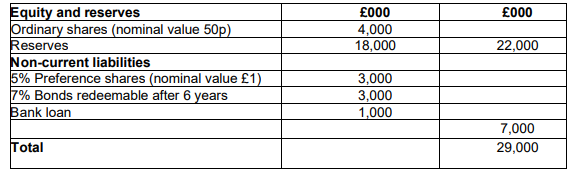

Delta Ltd wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. The following financial information relates to Delta Ltd:

Financial Position statement extracts as at 31 December 2022 Are You Looking for Answer of This Assignment or Essay

The ordinary shares of Delta Ltd have an ex-div market value of £4.70 per share and an ordinary dividend of £0.36 per share has just been paid. Ordinary dividends are expected to grow in the future by 4% per year.

The preference shares of Delta Ltd are not redeemable and have an ex-div market value of £0.40 per share.

The 7% bonds are redeemable at a 5% premium to their nominal value of £100 per bond and have an ex-interest market value of £104.50 per bond.

The bank loan has a variable interest rate that has averaged 4% per year in recent years.

Delta Ltd pays profit tax at an annual rate of 19% per year.

Required:

a) Calculate the market value Weighted Average Cost of Capital (WACC) of Delta Ltd.

b) Discuss the pros and cons of using the WACC as a discount rate to evaluate capital budgeting projects.

c) Explain the impact of tax on the WACC according to the modified Modigliani & Miller (M&M II, 1963) capital structure model.

Are You Looking for Answer of This Assignment or Essay

Elevate your academic experience with our tailored support – Assignment Helper UK and specialized Finance Assignment Help Services in the UK. Crafted for students at Arden University (AU), our expertise extends to Financial Management, focusing on the intricacies of FIN6003.

Explore the challenge faced by Delta Ltd as they aim to calculate their current cost of capital for use as a discount rate in investment appraisal. UK students seeking guidance can invest in their academic success by leveraging our expert assistance. Simplify financial complexities, ensure excellence, and advance confidently in your coursework with our dedicated support.