- Explain How To Achieve Positive Interactions Within An Adult Care Setting/service Considering: Level 5 Diploma in Leadership and Management for Adults Care Assignment, DC, UK

- Unit 6: Website Development Pearson BTEC Level 3 National Extended Certificate in Information Technology Assignment, UK

- TQUK Level 4 Certificate in Higher Level Teaching Assistant (RQF) Assessment Task Unit 3 , Assignment, UK

- Describe the different forms that energy can take: radiography Assignment, UOL, UK

- Explain the difference between velocity and acceleration. You must include suitable drawings: radiography Assignment, UOL, UK

- CP70042E: Write an essay to explore the network attacks and new access control challenges: Network and System Security (Level 7) Assignment, UWL, UK

- Critically analyse one competitor website / blog and use of content and social media: Digital marketing Assignment, UOS, UK

- 5ENT2044: A group-based but individually submitted project incorporating a survey based on the Level 5 field course: civil engineering Assignment, UK

- Analyse how statutory frameworks underpin service provision: Level 4 in Lead practitioner in Adult Care Assignment, UK

- “Expansionary fiscal policies stimulate private consumption and investments”: explain and discuss: Macroeconomics Assignment, UNIS, UK

- Prepare a project time plan to develop the software program: Engineering unit 35 Assignment, UK

- ‘Fostering employee wellbeing is good for people and the organization’. CIPD (2022) Drawing upon published research: CIPD Level 7 Assignment, UK

- Officers are concerned the reptiles could have been a source of contamination of the food: Food control and hygiene management Assignment, UOEL, UK

- Develop a SWOT analysis of the current situation at AlphaCo: Operations and Information Management Assignment, UOS, Uk

- Your company produces radio transmitters and part of that circuit multiplies a high frequency sinusoidal carrier: engineering Assignment, TUOS, Uk

- The diagram shows a DC resistor network. The network is supplied by a 12 V battery: Unit 57 – Electrical and Electronic Principles Assignment, UK

- An engineer has completed two tests on two conductors: Unit 57 – Electrical and Electronic Principles Assignment, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work,

- Sea Dolphin Ltd entered into a contract with Marine Adventure Shipping Ltd for the carriage of 5 tonnes of frozen fish: International Commercial Law Assignment, CUL, Uk

- 1.1 Explain what is meant by: personal wellbeing, self-care, resilience: Health and Social care Assignment, UOG, UK

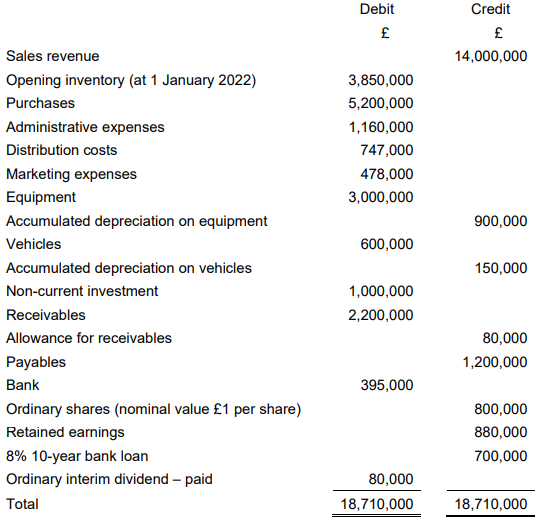

Below is the trial balance for Petronella Ltd as of 31 December 2022. Petronella Ltd Trial balance on 31 December 2022: Financial Accounting In Context Assignment, OU, UK

| University | The Open University (OU) |

| Subject | Financial Accounting In Context |

Question 1

Below is the trial balance for Petronella Ltd as of 31 December 2022.

Petronella Ltd

Trial balance on 31 December 2022

The following information is relevant and not shown in the trial balance above.

- Closing inventory as of 31 December 2022 is £2,250,000.

- Irrecoverable receivables to be written off amount to £92,000.

- The allowance for receivables is to be set at 5% of net receivables at the

financial year’s end. - Petronella Ltd’s depreciation policy is as follows.

• Equipment is to be depreciated at 10% on a straight-line basis.

• Vehicles are to be depreciated at 25% on a reducing balance basis.

• No depreciation has been charged for the year ended 31 December

2022. - In October 2022, Petronella Ltd paid £60,000 of rent for the three-month period from 1 November 2022 until 31 January 2023. This amount is included in the figure for administrative expenses shown in the trial balance.

- The audit fee relating to the year ended 31 December 2022 is estimated to be £72,900. This has not been paid as of 31 December 2022.

- Irrecoverable receivables, depreciation on office equipment, marketing expenses, and audit fee are to be allocated to administrative expenses. Depreciation on vehicles is to be recorded under distribution costs.

- The 8% bank loan is repayable in ten years’ time. Interest is paid once per year and has not been paid as of 31 December 2022.

- The corporation tax rate for the year ended 31 December 2022 is 30%.

Buy Answer of This Assessment & Raise Your Grades

Question 2

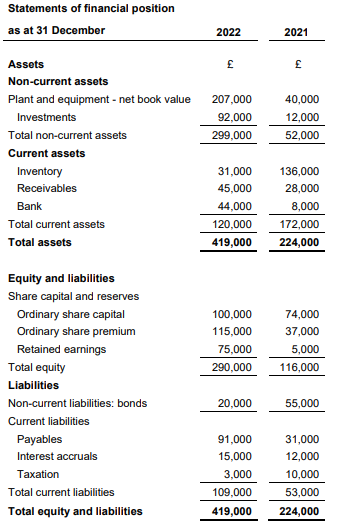

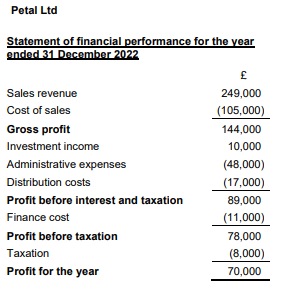

The financial statements for Petal Ltd are given below.

Petal Ltd

The following information is relevant:

- During the year, plant and equipment were sold. The equipment had originally cost £12,000 and the accumulated depreciation on the date of disposal was £5,000. The proceeds were £15,000.

- The depreciation charge for the year is £51,000.

- Investment income relates only to interest.

Do You Need Assignment of This Question

Studentsassignmenthelp.co.uk is the go-to site for students who want to pay for college assignments online. Our team of experienced experts is on hand to provide assistance with a wide range of assignments, from essay writing and coursework to dissertations and research projects. We have some of the most competitive rates in the industry, so you’re sure to get great value for money without compromising on quality service. Contact us today and get assignment help online today!