- Lead Adult Care Worker Level 3 Safeguarding Assessment | Salford City College

- K/650/1144 Professional Development and Academic Writing Skills Assessment

- M26753 Mechanical Principles Assignment Brief | University Centre IOW

- Care Safeguiding Children Assignment | Oxford Brookes University

- PSY4011 Developmental Psychology Assessment Brief | Arden University

- QSP7PCM Professional Cost Management Assignment 2 September 2025 | UCEM

- EGR2006M Control Systems Assignment 1 Brief | University of Lincoln

- MBA7066 Innovation and Entreprenuership Assignment Portfolio 2025 | UGM

- Contract Law Assessment 2 Problem Scenario 2025-26 | University Of Salford

- Operations & Supply Chain Management Assignment Brief : E-Commerce Supply Chain Efficiency

- Unit 1 Programming Assignment 2025-26 | ESOFT Metro Campus

- K/651/4745 Unit 1 Teaching My Subject Written Assignment | Britannia Education Group

- H/650/1099 Level 4 Academic Writing and Research Skills Assignment Brief | LSBU

- ASB-4012 Codding for Business Application Assignment – Project in R | Bangor University

- Unit: Team Management in Health and Social Care OTHM Level 5 Diploma Assignment

- BTEC Level 3 Unit 4 Programming Assignment – Concepts of Programming

- HSO4004 Principles of Care Assignment-1 and Assignment-2 Semester-1 September 2025-26

- 1031ENG-N Civil Engineering Construction Technology In-Course Assessment (ICA) Group Report | Teesside University (TU)

- MOD009382 Finance and Governance in Health and Social Care 011 Assessment Coursework Report | Anglia Ruskin University

- Geotechnical Engineering Assignment 2025/26 – University Of Surrey (UniS)

FIN6003 Delta Ltd wishes to calculate its current cost of capital for use as a discount rate in investment appraisal: Financial Management Assignment, AU, UK

| University | Arden University (AU) |

| Subject | FIN6003 Financial Management Assignment |

Question 3

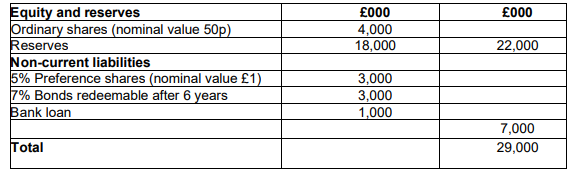

Delta Ltd wishes to calculate its current cost of capital for use as a discount rate in investment appraisal. The following financial information relates to Delta Ltd:

Financial Position statement extracts as at 31 December 2022 Are You Looking for Answer of This Assignment or Essay

The ordinary shares of Delta Ltd have an ex-div market value of £4.70 per share and an ordinary dividend of £0.36 per share has just been paid. Ordinary dividends are expected to grow in the future by 4% per year.

The preference shares of Delta Ltd are not redeemable and have an ex-div market value of £0.40 per share.

The 7% bonds are redeemable at a 5% premium to their nominal value of £100 per bond and have an ex-interest market value of £104.50 per bond.

The bank loan has a variable interest rate that has averaged 4% per year in recent years.

Delta Ltd pays profit tax at an annual rate of 19% per year.

Required:

a) Calculate the market value Weighted Average Cost of Capital (WACC) of Delta Ltd.

b) Discuss the pros and cons of using the WACC as a discount rate to evaluate capital budgeting projects.

c) Explain the impact of tax on the WACC according to the modified Modigliani & Miller (M&M II, 1963) capital structure model.

Are You Looking for Answer of This Assignment or Essay

Elevate your academic experience with our tailored support – Assignment Helper UK and specialized Finance Assignment Help Services in the UK. Crafted for students at Arden University (AU), our expertise extends to Financial Management, focusing on the intricacies of FIN6003.

Explore the challenge faced by Delta Ltd as they aim to calculate their current cost of capital for use as a discount rate in investment appraisal. UK students seeking guidance can invest in their academic success by leveraging our expert assistance. Simplify financial complexities, ensure excellence, and advance confidently in your coursework with our dedicated support.