- CP70042E: Write an essay to explore the network attacks and new access control challenges: Network and System Security (Level 7) Assignment, UWL, UK

- Critically analyse one competitor website / blog and use of content and social media: Digital marketing Assignment, UOS, UK

- 5ENT2044: A group-based but individually submitted project incorporating a survey based on the Level 5 field course: civil engineering Assignment, UK

- Analyse how statutory frameworks underpin service provision: Level 4 in Lead practitioner in Adult Care Assignment, UK

- “Expansionary fiscal policies stimulate private consumption and investments”: explain and discuss: Macroeconomics Assignment, UNIS, UK

- Prepare a project time plan to develop the software program: Engineering unit 35 Assignment, UK

- ‘Fostering employee wellbeing is good for people and the organization’. CIPD (2022) Drawing upon published research: CIPD Level 7 Assignment, UK

- Officers are concerned the reptiles could have been a source of contamination of the food: Food control and hygiene management Assignment, UOEL, UK

- Develop a SWOT analysis of the current situation at AlphaCo: Operations and Information Management Assignment, UOS, Uk

- Your company produces radio transmitters and part of that circuit multiplies a high frequency sinusoidal carrier: engineering Assignment, TUOS, Uk

- The diagram shows a DC resistor network. The network is supplied by a 12 V battery: Unit 57 – Electrical and Electronic Principles Assignment, UK

- An engineer has completed two tests on two conductors: Unit 57 – Electrical and Electronic Principles Assignment, UK

- DAT7303: In portfolio 3, students must complete 4 tasks related to analysing a dataset using CRISP- DM methodology: Data Mining Course Work,

- Sea Dolphin Ltd entered into a contract with Marine Adventure Shipping Ltd for the carriage of 5 tonnes of frozen fish: International Commercial Law Assignment, CUL, Uk

- 1.1 Explain what is meant by: personal wellbeing, self-care, resilience: Health and Social care Assignment, UOG, UK

- Explain the purpose and principles of independent advocacy: Health and Social care Assignment, UOG, UK

- Demonstrate a range of effective communication styles, methods and skills: Health and Social care Assignment, UOG, UK

- Describe the range of communication styles, methods, and skills available: Health and Social care Assignment, UOG, UK

- Describe the main purpose and principles of relevant legislation and codes of practice relating to mental capacity: The Principles Of Mental Capacity And Restrictive Practice Assignment, OU, Uk

- 5OS01: Evaluate the principles of discrimination law in recruitment, selection and employment. (AC 2.1): Specialist Employment Law Assignment, CIPD, UK

BB5112: The Providential Insurance Company has developed a list of seven investment alternatives, with corresponding financial factors: Business Decision Modelling Assignment, KUL, UK

| University | Kingston University London (KUL) |

| Subject | BB5112: Business Decision Modelling |

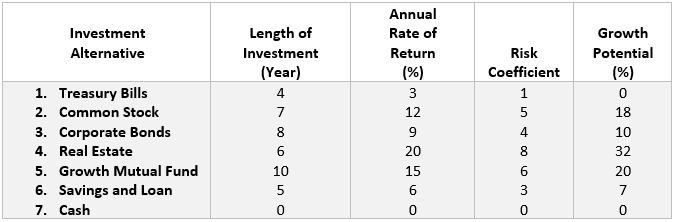

The Providential Insurance Company has developed a list of seven investment alternatives, with corresponding financial factors, for a 10-year investment horizon. These investments and their corresponding financial factors are presented in the following table. With this table, the meaning of the various financial factors is as follows:

- The length of investment – the expected number of years required for the annual rate of return to be realized, taking into account the possibility of reinvestment;

- The annual rate of return – the expected rate of return over the 10-year investment horizon;

- The risk coefficient – a subjective, dimensionless estimate representing the portfolio manager’s appraisal of the relative safety of each alternative, based on an ordinal scale of 10;

- The growth potential– a subjective estimate representing the portfolio manager’s appraisal of the potential increase in the value of the investment alternative for the 10-year period.

The Providential Insurance Company seeks to maximize the return on its portfolio of investments, subject to the following restrictions on the selection of the portfolio:

- The average length of the investment for the portfolio should not exceed 7 years

- The average risk for the portfolio should not exceed 5

- The average growth potential for the portfolio should be at least 10%

- At least 10% of all available funds must be retained in the form of cash at all times in order to maintain working capital liquidity

- The proportions of funds invested in the various alternatives must sum to 1.0.

Are You Looking for Answer of This Assignment or Essay

Task

- Using clear notation, Identify the decision variables for this problem.

- Use these decision variables to formulate the firm’s objective function, clearly stating what the objective is.

- Use the information in Tables 1 and 2 above to identify the constraints for this problem.

- Using what you have identified in 1-3 above formulate and present the complete linear programming model for this problem.

- Enter the linear programming model you have derived in 4 above into Solver to obtain the optimal solution to the problem.

- Extract the optimal solution from Solver and state the value of the objective function, and the values of the decision variables then summarise the results, making clear the contribution to the Total Rate of Return made by each investment alternative.

- Using Solver extract a Sensitivity Report for the problem.

- From the Sensitivity Report extract the slack and surplus variables and interpret their meaning.

- Using the results of the Sensitivity Report indicates whether the optimal solution to the problem is unique or if there are alternative optimal solutions.

- Present a brief interpretation of the ranging information on the objective function coefficients presented in the Sensitivity Report for this problem.

- Identify the shadow prices from the Sensitivity Report and interpret their meaning.

- Using the shadow price on the average length of investment indicates the impact on the objective function of increasing the length by 1 year. What is the upper limit of the availability of component 1 for which this shadow price is valid?

- What would be the impact of increasing the liquidity requirement by 1 percent?

Do You Need Assignment of This Question

Looking for a reliable and trustworthy essay writer UK? Look no further than Studentsassignmenthelp.co.uk! Our team of expert essay writers is ready to help you with all your academic needs. We understand the importance of deadlines, and we work hard to ensure that all assignments are delivered on time. We offer affordable prices, exceptional quality, and outstanding customer support. So, get in touch with us to get the best assignment help UK at the best prices!