- Unit 5 Understand the Role of the Social Care Worker Assessment Question 2026

- Leading and Managing Change Assessment 1 2026 | University of Greenwich

- 6F7V0020 Biodiversity, Natural Capital and Ecosystem Services Summative In-Course Assessment Briefing 2026

- BTEC HND Level 5 Unit 4 The Hospitality Business Toolkit Assignment Brief 2026

- BTEC Level 3 Unit 2 Working in Health and Social Care Assigment 2026

- BTEC Level 1-2 Unit 20 Building a Personal Computer Internal Assessment 2026

- BTEC Level 2 Unit 11 Computer Networks Assignment Brief 2026 | Pearson

- BTEC Level 4/5 Unit 06 Construction Information Assignment Brief 2026

- BA601 Management Control Qualifi Level 6 Assessment Brief 2026 | UEL

- MLA603 Maritime Regulation and Governance Assessment Brief 2026 | MLA College

- Introduction to Organizational Behavior Assessment Critical Essay | NTU

- ILM Level 4 Unit 416 Solving Problems by Making Effective Decisions in the Workplace Assignment

- NURS08059 Resilience in Healthcare Assignment Guide 2026 | UWS

- ILM Level 4 Unit 409 Managing Personal Development Assignment 2026

- BTEC Level 3 Unit 1 Axborot Texnologiyalari Tizimlari Assignment Brief 2026

- NI523 Approaches to Nursing Adults with Long Term Conditions Assignment Workbook 2026 | UOB

- GBEN5004 Social Entrepreneurship Assignment Brief 2026 | Oxford Brookes University

- EBSC6017 Data Mining for Marketers Unit Handbook 2026 | UCA

- A7080 Recent Advances in Ruminant Nutrition Individual Assignment 2025/26 | HAU

- ST2187 Business Analytics, Applied Modelling and Prediction Assignment | UOL

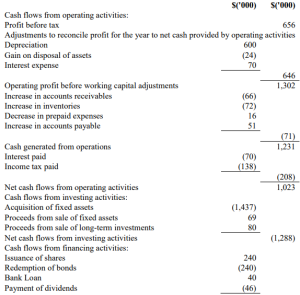

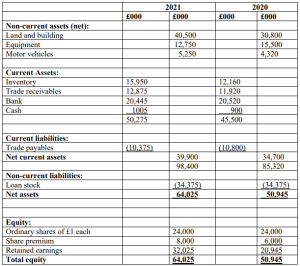

PGBM01: Kadlex Consultancy (KC) PLC Kadlex PLC has well established Financial Consultancy company in London: FINANCIAL MANAGEMENT AND CONTROL Assignment, US, UK

| University | University of Sunderland (US) |

| Subject | PGBM01: FINANCIAL MANAGEMENT AND CONTROL |

Part A

Question 1

Kadlex Consultancy (KC) PLC Kadlex PLC has well established Financial Consultancy company in London. The board of directors have investigated the financial statements of the last two years and have noticed significant changes in different elements of Income statements and Balance sheets. You are working in the same company as a junior management accountant and directors have asked you to prepare a report on results of the two year’s financial statements. The financial statement of the KC PLC are given below:

Statement of Comprehensive Income for the year ended 2020 and 2021.

Statement of financial position as at 31st of December 2020 and 2021.

Required:

1. Prepare a structured report for Board of Kadlex PLC, which critically evaluates the performance of the company in relation to relevant ratios of the Profitability, Liquidity, Gearing, Asset utilisation, Investors’ potential. Your report must be supported by the calculations of relevant ratios in the five areas mentioned above.

2. Easy-Life Limited, a London based Event Organiser is as a strategic business unit of KC PLC. Sales revenue and direct costs for one event is £1000 and £600 respectively.

Total fixed cost for the year ending December 2021 was £160,000.

Calculate breakeven in both sales (unit and cash), contribution margin ratio, and operating leverage (assuming actual sales quantity of 700 units was increased by 10%).

Critically discuss how each of these three metrics can be used to impact on any of the profitability ratios in Task 1 above.

Part B

Perri-perri Sauce (PPS)Ltd, is well established London based fast-food company. The directors are expecting that demand of meal in future will increase significantly and with current capacity company will not be able to meet the demand.

Therefore, directors have decided to purchase a new machine to enhance the capacity to benefit from the expected increase in demand. Two versions of machines are available from different manufacturers at the same cost of £600,000. Both machines have six years useful life and will be sold at estimated price of £60,000 at the end of sixth year. PPS Ltd will use straight line method for depreciation of these machines. Cost of capital for both machines is 8%.

Directors are to purchase one machine from the available two, same cost and net cash inflow from both machines is confusing them to take decision. You are Finance Manager of PPS Ltd and directors have asked to produce a report which should highlight the economic feasibility for decision making. Further information regarding net cash inflow from both machines is provided below:

Required:

1. Calculate (2-decimal places) using the following investment appraisal techniques, and provide recommendations as to the economic feasibility of acquiring the suitable machine:

a. The Payback Period.

b. The Discounted Payback Period.

c. The Accounting Rate of Return.

d. The Net Present Value.

e. The Internal Rate of Return (to two decimal places)

2. Critically evaluate the key benefits and limitations of each of the differing investment appraisal techniques, supporting the response with relevant academic research as to whether each of the differing techniques is applied in practice within a real-life business context.

3. You are also required to critically evaluate three suitable sources of finance to fund PPS Ltd in this investment as compared to a listed company

Part C: Budgeting and Financial plan

Required:

Research a multinational organisation of your choice and complete the following task:

1. Critically evaluate the budgeting process and demonstrate how budgets,

objectives, and strategic plans are related. Marks (12%)

2. Briefly discuss the significance of Business plan and analyse the key elements of it financial plan section.

Buy Answer of This Assessment & Raise Your Grades

if you are looking for expert writers to do my assignment for me on FINANCIAL MANAGEMENT AND CONTROL then consult the Students Assignment Help UK. here we have a team of dedicated experts who are always ready to serve the faultless solution on finance assignments at a market price.