- BTEC Level 5 Unit 28 Risk Analysis & Systems Testing Assignment Brief

- IS1S451 Information Systems Analysis and Design 1 Assignment | USW

- Economics Undergraduate Assessment Criteria | University of Manchester

- BTEC Level 5 Unit 17 Business Process Support Assignment Brief 2026

- QSP7PCM Professional Cost Management Assignment 2, September 2025 | UCEM

- LD7008 Wireless Networks and Security Assessment 2 Brief 2026 | NU

- LD7008 Wireless Networks and Security Assessment 1 Brief 2026

- HSO4008 Introduction to Evidence-Based Research Assignment Brief 2026

- MAN-40355 Achieving Excellence through Managing Operations Assessment Report 2026

- COM6016 Distributed and Cloud Computing Assessment Brief 2026

- BTEC Level 5 Unit 4 Database Design & Development Assignment Brief 2026

- BTEC Level 3 Unit 13 Introduction to Criminology Assignment Brief

- BTEC International Level 3 Unit 8 Human Resources Assignment Brief 2026

- BTEC Level 4 Unit 9 Entrepreneurial Ventures Assignment Brief 2026

- COM6013 Cybersecurity and AI Dissertation Project Assessment Brief 2026

- ACC4043-N Contemporary Management In Operations And Finance ECA 2026

- BMGT2300 Digital Content Systems and Ecommerce Assignment 1 Brief 2026

- BMGT3000 Digital and Social Media Marketing Assignment 1 Brief 2026

- MN5619 Research Project Assessment Brief 2026 | Brunel University

- U14521 Relationships and Sex Education Assessment 2 Brief 2026

In 2021 the company purchased direct raw material RM45,000, and direct labor cost RM31,000: corporate finance Assignment, QMUL, UK

| University | Queen Mary University of London (QMUL) |

| Subject | Corporate Finance |

CORPORATE FINANCE TEST (25%)

QUESTION 1

Explain 4 (FOUR) quality cost with examples. (10 marks)

QUESTION 2

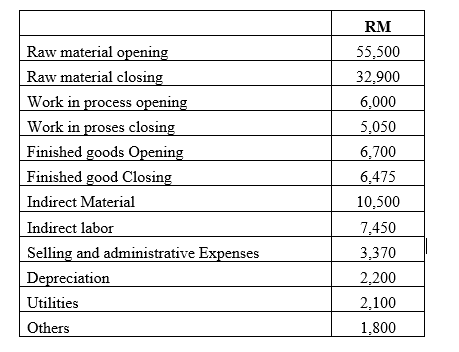

In 2021 the company purchased direct raw material RM45,000, and direct labor cost RM31,000. Prepare Cost of goods sold schedule for the company.

Buy Answer of This Assessment & Raise Your Grades

QUESTION 3

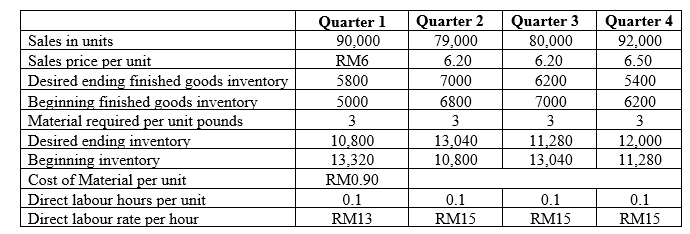

Using above information prepare following budget:

- Production budget

- Direct material Budget

- Direct labor budget

QUESTION 4

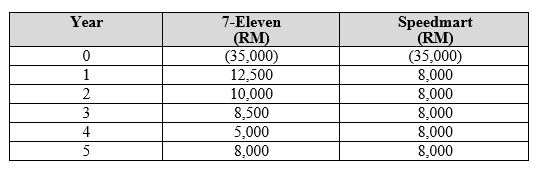

Belton Sdn Bhd is considering one of the two mutually exclusive projects, 7-ELEVEN and SPEEDMART. The company’s discount rate is at 6%. The expected after tax cash flows for both projects are as follows:

As the company’s financial manager, you are required to:

- Calculate the payback back period for project 7-Eleven and

- Calculate the Net Present Value for project 7-Eleven and

- Calculate the Internal rate of return for p project 7-ELEVEN and Speedmart.

- Determine the best project that Belton Sdn Bhd should invest Justify your answer.

Are You Looking for Answer of This Assignment or Essay

Struggling with your Corporate Finance Assignment in the UK? Our assignment writing help UK service specializes in Finance Assignment Help for UK students. Delve into the intricacies of financial transactions like direct raw material and labor costs without stress.

Pay our experts for invaluable assistance, allowing you to focus on mastering the subject. Let us guide you through this assignment, ensuring your academic success effortlessly. Trust our expertise and excel in your studies!