- IS1S451 Information Systems Analysis and Design 1 Assignment | USW

- Economics Undergraduate Assessment Criteria | University of Manchester

- BTEC Level 5 Unit 17 Business Process Support Assignment Brief 2026

- QSP7PCM Professional Cost Management Assignment 2, September 2025 | UCEM

- LD7008 Wireless Networks and Security Assessment 2 Brief 2026 | NU

- LD7008 Wireless Networks and Security Assessment 1 Brief 2026

- HSO4008 Introduction to Evidence-Based Research Assignment Brief 2026

- MAN-40355 Achieving Excellence through Managing Operations Assessment Report 2026

- COM6016 Distributed and Cloud Computing Assessment Brief 2026

- BTEC Level 5 Unit 4 Database Design & Development Assignment Brief 2026

- BTEC Level 3 Unit 13 Introduction to Criminology Assignment Brief

- BTEC International Level 3 Unit 8 Human Resources Assignment Brief 2026

- BTEC Level 4 Unit 9 Entrepreneurial Ventures Assignment Brief 2026

- COM6013 Cybersecurity and AI Dissertation Project Assessment Brief 2026

- ACC4043-N Contemporary Management In Operations And Finance ECA 2026

- BMGT2300 Digital Content Systems and Ecommerce Assignment 1 Brief 2026

- BMGT3000 Digital and Social Media Marketing Assignment 1 Brief 2026

- MN5619 Research Project Assessment Brief 2026 | Brunel University

- U14521 Relationships and Sex Education Assessment 2 Brief 2026

- BMAF004-20 Introduction to Business and Management Assessment Brief

Calculate the following for your company and provide the screenshot of your answers if you use excel: Real Estate Asset Management Assignment, UOM, UK

| University | University of Manchester(UoM) |

| Subject | Real Estate Asset Management |

Question 1

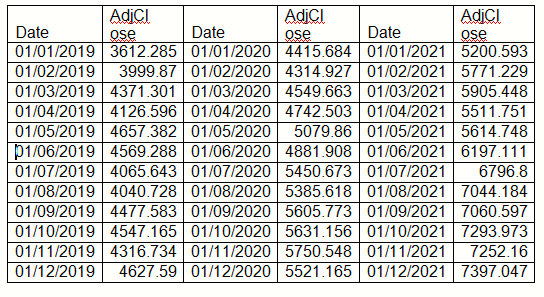

The adjusted Closing price for AppleIncis provide in the following table

Calculate the following for your company and provide the screenshot of your answers if you use excel. If you use a calculator please show all your calculations:

Calculate the Holding Period Returns for 2019,2020 and2021.

Calculate the Annual Standard Deviations for 2019,2020 and2021.

- AssuminganannualRisk-FreeRateof1.5%,whatwastheRiskPremiumforeachofthethreeyears?

- WhatwastheSharpeRatio ineach of the three years?

- Calculate and explain the results of your allocated company’s Capital AllocationLineoverthefull3-year period.

Question 2

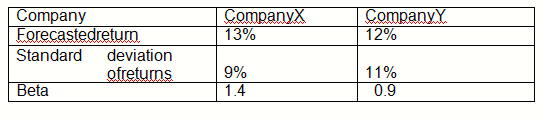

The T-billrateis 3.5% and the market risk premiumis 8%.

What would be the fair return for each company according to the capital asset pricing model (CAPM)?

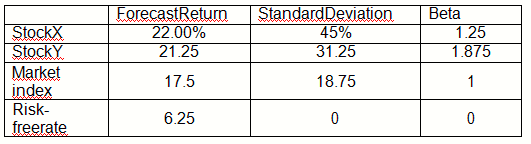

Jony Depp, a fund manager at Fidelity McGillan fund, is using the capital asset pricing model for making recommendations to his clients. He has produced the information shownn in the following exhibit.

Identify and justify which stock would be more appropriate for an investor who wants stoaddt his Stockton a well-diversified equity portfolio? Which stock would be more appropriate for a single-stock portfolio? Explain your answers.

Buy Answer of This Assessment & Raise Your Grades

Students Assignment Help UK offers a high-quality academic writing service to college and university students. our experts have relevant industry experience in the various subject fields. our writers are available 24*7 hours to provide management assignment help at a cost-effective price.