- DSM030 Statistics and Statistical Data Mining Assignment Brief 2026 | UOL

- Unit 5 Understand the Role of the Social Care Worker Assessment Question 2026

- Leading and Managing Change Assessment 1 2026 | University of Greenwich

- 6F7V0020 Biodiversity, Natural Capital and Ecosystem Services Summative In-Course Assessment Briefing 2026

- BTEC HND Level 5 Unit 4 The Hospitality Business Toolkit Assignment Brief 2026

- BTEC Level 3 Unit 2 Working in Health and Social Care Assigment 2026

- BTEC Level 1-2 Unit 20 Building a Personal Computer Internal Assessment 2026

- BTEC Level 2 Unit 11 Computer Networks Assignment Brief 2026 | Pearson

- BTEC Level 4/5 Unit 06 Construction Information Assignment Brief 2026

- BA601 Management Control Qualifi Level 6 Assessment Brief 2026 | UEL

- MLA603 Maritime Regulation and Governance Assessment Brief 2026 | MLA College

- Introduction to Organizational Behavior Assessment Critical Essay | NTU

- ILM Level 4 Unit 416 Solving Problems by Making Effective Decisions in the Workplace Assignment

- NURS08059 Resilience in Healthcare Assignment Guide 2026 | UWS

- ILM Level 4 Unit 409 Managing Personal Development Assignment 2026

- BTEC Level 3 Unit 1 Axborot Texnologiyalari Tizimlari Assignment Brief 2026

- NI523 Approaches to Nursing Adults with Long Term Conditions Assignment Workbook 2026 | UOB

- GBEN5004 Social Entrepreneurship Assignment Brief 2026 | Oxford Brookes University

- EBSC6017 Data Mining for Marketers Unit Handbook 2026 | UCA

- A7080 Recent Advances in Ruminant Nutrition Individual Assignment 2025/26 | HAU

Below is the trial balance for Petronella Ltd as of 31 December 2022. Petronella Ltd Trial balance on 31 December 2022: Financial Accounting In Context Assignment, OU, UK

| University | The Open University (OU) |

| Subject | Financial Accounting In Context |

Question 1

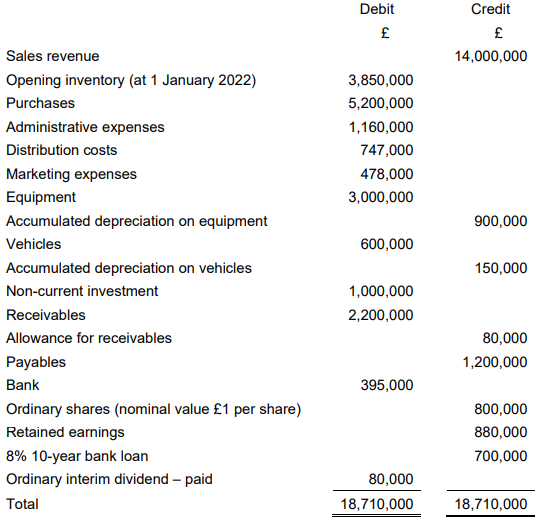

Below is the trial balance for Petronella Ltd as of 31 December 2022.

Petronella Ltd

Trial balance on 31 December 2022

The following information is relevant and not shown in the trial balance above.

- Closing inventory as of 31 December 2022 is £2,250,000.

- Irrecoverable receivables to be written off amount to £92,000.

- The allowance for receivables is to be set at 5% of net receivables at the

financial year’s end. - Petronella Ltd’s depreciation policy is as follows.

• Equipment is to be depreciated at 10% on a straight-line basis.

• Vehicles are to be depreciated at 25% on a reducing balance basis.

• No depreciation has been charged for the year ended 31 December

2022. - In October 2022, Petronella Ltd paid £60,000 of rent for the three-month period from 1 November 2022 until 31 January 2023. This amount is included in the figure for administrative expenses shown in the trial balance.

- The audit fee relating to the year ended 31 December 2022 is estimated to be £72,900. This has not been paid as of 31 December 2022.

- Irrecoverable receivables, depreciation on office equipment, marketing expenses, and audit fee are to be allocated to administrative expenses. Depreciation on vehicles is to be recorded under distribution costs.

- The 8% bank loan is repayable in ten years’ time. Interest is paid once per year and has not been paid as of 31 December 2022.

- The corporation tax rate for the year ended 31 December 2022 is 30%.

Buy Answer of This Assessment & Raise Your Grades

Question 2

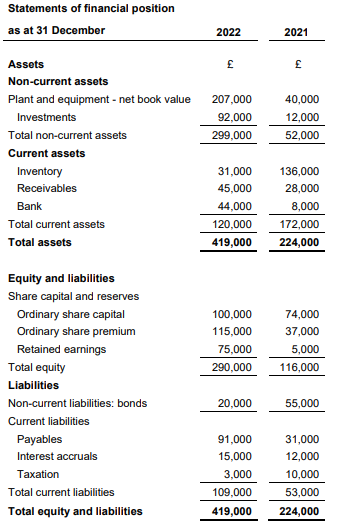

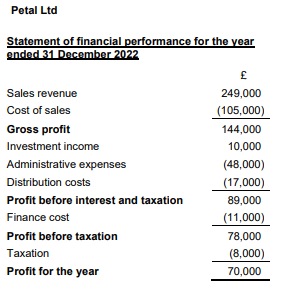

The financial statements for Petal Ltd are given below.

Petal Ltd

The following information is relevant:

- During the year, plant and equipment were sold. The equipment had originally cost £12,000 and the accumulated depreciation on the date of disposal was £5,000. The proceeds were £15,000.

- The depreciation charge for the year is £51,000.

- Investment income relates only to interest.

Do You Need Assignment of This Question

Studentsassignmenthelp.co.uk is the go-to site for students who want to pay for college assignments online. Our team of experienced experts is on hand to provide assistance with a wide range of assignments, from essay writing and coursework to dissertations and research projects. We have some of the most competitive rates in the industry, so you’re sure to get great value for money without compromising on quality service. Contact us today and get assignment help online today!