- DSM030 Statistics and Statistical Data Mining Assignment Brief 2026 | UOL

- Unit 5 Understand the Role of the Social Care Worker Assessment Question 2026

- Leading and Managing Change Assessment 1 2026 | University of Greenwich

- 6F7V0020 Biodiversity, Natural Capital and Ecosystem Services Summative In-Course Assessment Briefing 2026

- BTEC HND Level 5 Unit 4 The Hospitality Business Toolkit Assignment Brief 2026

- BTEC Level 3 Unit 2 Working in Health and Social Care Assigment 2026

- BTEC Level 1-2 Unit 20 Building a Personal Computer Internal Assessment 2026

- BTEC Level 2 Unit 11 Computer Networks Assignment Brief 2026 | Pearson

- BTEC Level 4/5 Unit 06 Construction Information Assignment Brief 2026

- BA601 Management Control Qualifi Level 6 Assessment Brief 2026 | UEL

- MLA603 Maritime Regulation and Governance Assessment Brief 2026 | MLA College

- Introduction to Organizational Behavior Assessment Critical Essay | NTU

- ILM Level 4 Unit 416 Solving Problems by Making Effective Decisions in the Workplace Assignment

- NURS08059 Resilience in Healthcare Assignment Guide 2026 | UWS

- ILM Level 4 Unit 409 Managing Personal Development Assignment 2026

- BTEC Level 3 Unit 1 Axborot Texnologiyalari Tizimlari Assignment Brief 2026

- NI523 Approaches to Nursing Adults with Long Term Conditions Assignment Workbook 2026 | UOB

- GBEN5004 Social Entrepreneurship Assignment Brief 2026 | Oxford Brookes University

- EBSC6017 Data Mining for Marketers Unit Handbook 2026 | UCA

- A7080 Recent Advances in Ruminant Nutrition Individual Assignment 2025/26 | HAU

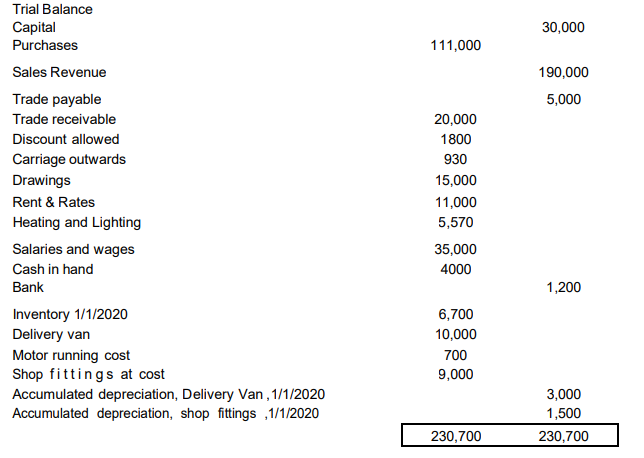

AC4052QA Elwira Ventures: The following trial balance was extracted from the books of Elwira Ventures: Financial Accounting Assignment, LMU, UK

| University | London Metropolitan University (LMU) |

| Subject | AC4052QA Financial Accounting |

Question 2

Elwira Ventures

The following trial balance was extracted from the books of Elwira Ventures, a spare parts merchant, at the close of business on 31 December 2020

Do You Need Assignment of This Question

Additional Information

1. Inventory on 31 December 2020 was £3,400.

2. Elwira took out spare parts costing £500 for the repair of her private car.No

payment was made for these goods.

3. Rent prepaid on 31 December 2020 was £1,200.

4. Motor running expenses owing on 31 December 2020 was £90.

5. Provide for depreciation on 31 Dec 2020 as follows: Delivery Van 45% on the reducing balance basis and Shop fittings 35% on the straight-line basis.

Required:

a) Draw up Elwira Ventures income statement for the year ended31December2020

b) Draw up Elwira statement of financial position as at 31 December 2020

c) In one sentence, state the effect of the following on income statement andstatement of financial position.

i. Prepaid income.

ii. Prepaid expense.

iii. Accrued income.

iv. Accrued expense.

Buy Answer of This Assessment & Raise Your Grades

Are you a student at London Metropolitan University (LMU) struggling with your AC4052QA Financial Accounting assignment? Look no further! We specialize in providing top-notch assignment writing help UK services tailored to meet the academic needs of LMU students. Our expert team is well-equipped to assist you in tackling challenging topics like the trial balance extracted from the books of Elwira Ventures.

Say goodbye to academic stress and excel in your Financial Accounting course with our reliable Accounting Assignment Help specifically designed for LMU students. Trust us to guide you through your coursework, allowing you to focus on your studies while we handle the intricacies of your assignments.