- OTHM Level 5 Unit H/650/1142 Professional Supervision Assignment: Health & Social Care Case for Managing Supervision and Performance

- ATHE Level 4 Unit 15 Software Testing Frameworks Assignment: TDD and BDD Strategy for Medical Data Validation Script in Python

- ATHE Level 4 Unit 12 Web Design and Programming Assignment: CTO Birdwatching App Development for Urban Wildlife Insights

- ATHE Level 4 Unit 21 Synoptic Computing Project Assignment: Smart Parking App Design for Urban Mobility Solution

- ATHE Level 4 Unit 1 IT Systems Development Assignment: The World of Art Case Study for Global Online Sales Expansion

- CYP6032 Leading Multi-Agency Health & Social Care Assignment: Vulnerable Groups Literature Review and Reflective Evaluation

- Unit 21 – L/618/8101 Geotechnical Design Assignment 1: Scunthorpe Station Overpass & Bridge Infrastructure Proposal

- Y/616/7445 Unit 039 Diabetes Awareness Assignment: Understanding, Managing and Supporting Individuals with Diabetes

- DHCS 12 (M/650/5189) Understand Mental Ill Health Assignment: Explore DSM/ICD Disorders, Discrimination & Capacity

- Unit 8 Social Media Strategy Assignment 2: Planning, Execution & Evaluation for Organisational Growth

- CIPD Level 7CO01 Strategic People Management Assignment: Demographic Trends, Legal Reforms, Innovation & Resilience in the Workplace

- Financial Accounting Assignment: Lee’s Sole Trader Transactions & Cash Flow Analysis

- L/508/4603 NCFE Level 3 Sport and Exercise Massage Assignment 3: Consultation & Technique Review for Two Contrasting Athletes

- F/650/1141 Unit 4 Team Management and Recruitment Assignment: Health & Social Care Case Study for Effective Leadership and PDPA-Compliant Hiring

- R/650/1138 OTHM Level 5 Assignment: Working in Partnership in Health and Social Care

- NVQ Level 3 Health and Safety Risk Management Assignment: Practical Assessment and Workplace Application

- MBA7068 Strategic Portfolio Assignment 1: Global Business Trends and Managerial Skill Development

- Mechanical Services Innovation: Hotel Rotation Case Study for Energy-Efficient Heat Pump Integration

- K/618/4170 ATHE Level 3 Unit 4 Assignment: Working in Health and Social Care

- T/618/4169 ATHE Level 3 Unit 3 Assignment: Human Growth and Development in Health and Social Care

You are a junior accountant in a small accountancy firm and you have been asked to prepare and produce a range of final accounts: Financial Accounting Assignment, CTIC,UK

| University | Chindwin Tu International College (CTIC) |

| Subject | Financial Accounting |

Scenario

You are a junior accountant in a small accountancy firm and you have been asked to prepare and produce a range of final accounts for a number of different businesses. You have been provided with a range of individual company’s financial details from which to create a general ledger, a trial balance, income statement and balance sheet. You will need to make adjustments as required and once the general ledger is completed. Once completed you will present to your line manager a portfolio of final accounts that includes a reflective summary that compares the different types of accounts produced.

You should cover the following in the introduction:

- What is financial accounting.

- Explain the difference between accounting and book-keeping.

- What is a business transaction?

Part 1

Record business transactions using double-entry book-keeping, and be able to extract a trial balance.

- 1, 2020, Mr Mason Brown started business with Cash $40,000.

- 3, he paid into the Bank $2,000.

- 5, he purchased goods for cash $15,000.

- 8, he sold goods for cash $6,000.

- 10, he purchased furniture and paid by cheque $5,000.

- 12, he sold goods to Mary $4,000 by credit.

- 14, he purchased goods from John $10,000.

- 15, he returned goods to John $5,000.

- 16, he received from Mary $3,960 in full settlement.

- 18, he withdrew goods for personal use $1,000.

- 20, he withdrew cash from business for personal use $2,000.

- 24, he paid telephone charges $1,000.

- 26, cash paid to John in full settlement $4,900.

- 31, paid for stationary $200, rent $ 500 and salaries to staff $2,000.\

Required;

- Apply the double entry book-keeping system of debits and credits. Record sales and purchases transactions in journal and a general ledger for the year 31 Dec 2020.

- Produce a trial balance as at 31 Dec 2020 by applying the use of the balance off rule to complete the ledger.

- Analyse sales and purchase transactions to compile a trial balance using double entry bookkeeping appropriately and effectively.

- Apply trial balance figures to show which statement of financial accounts they will end up in.

Part 2

Prepare final accounts for sole-traders, partnerships and limited companies in accordance with appropriate principles, conventions and standards.

Prepare final accounts for sole-traders

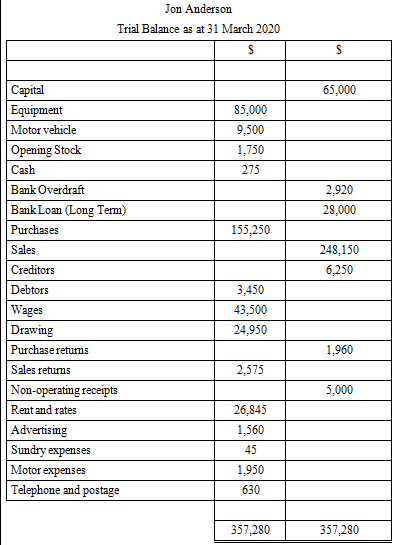

The following trial balance was extracted from the books of Jon Anderson, a sole trader at the close of the business on 31 March 2020.

Prepare a trading, profit and loss and appropriation account for the year and a balance sheet as at the end of the year for a sole trader. Take the following into account:

Addition Information:

Closing Stock $2,350

Depreciation on Straight-line Method Basis

Equipment 15% on Cost

Motor Vehicle 20% on Cost

Do You Need Assignment of This Question

Prepare final accounts for Partnerships

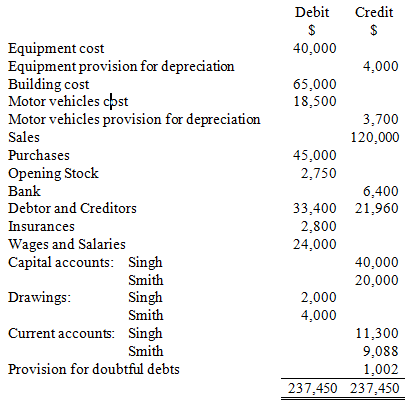

Mrs. Singh and Mr. Smith are in partnership and share profits and losses 2:1. A draft Trial Balance has been extracted from the partnership books of account at the end of the year, 31 December 2020

There are a number of items that need to be taken into consideration

- Depreciation is to be provided at 10% straight-line on equipment and 25% reducing balance on motor vehicles

- Closing stock is valued at $3,000.

- Insurance of $400 is prepaid and wages of $800 are to be accrued.

- The provision for doubtful debts is to be increased to 5% of debtors.

- Interest on drawings is charged at 5% p.a. on the balance in the trial balance.

- Interest on capital is allowed at 7%.

- Smith receives a salary of $4,000.

Required :

Prepare the Partnership Trading and Profit & Loss Account for the year ended, the Partnership Appropriation Account for the year ended and the Partners’ Current Accounts at 31 December 2020.

Prepare final accounts for Limited company

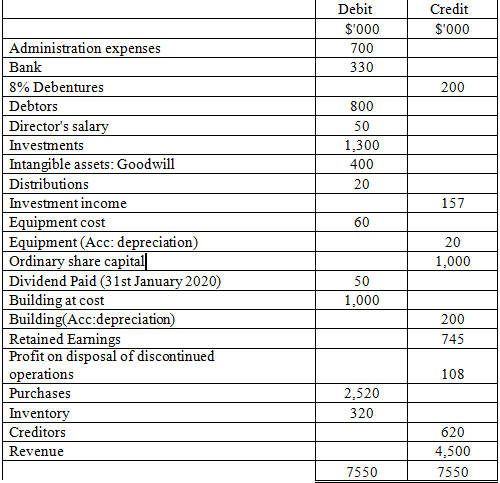

You are a business manager with Walker Brother Limited, a sportswear manufacturer producing mainly running wear. Your director has asked you to produce the draft financial statements for the year ended 31 July 2020, based on the trail balance below, which have been extracted from the accounting system and the information in the notes to the accounts.

Trial Balance for Walker Brother Limited at 31 July 2020

Notes to the accounts

- Inventory at 31 July 2020 was valued at $250,000.

- The following expenses were still outstanding

Administration costs $2,000

Director’s salary $6,000

- The Distribution costs include a prepayment $3,000 relating to the following year.

- Depreciation is to be charged on:

Building $100,000

Equipment $8,000

- Corporation tax charge on profits for the year is estimates to be $ 95,000

- Debenture interest is outstanding at the year-end.

Required:

- You are required to produce finals account Income Statement and Balance Sheet for Walker Brother Limited at 31 July 2020

- Make adjustments to balances of sum accounts for example, accruals, depreciation and prepayments before preparing the final accounts.

Compare the essential features of each financial account statement to analyze the differences between them in terms purpose, structure and content.

Do You Need Assignment of This Question

Struggling with your Financial Accounting assignments? Just relax our students assignment help UK is the most popular website in the UK. we have an outstanding team of professional experts to solve your accounting assignments problems you just hire our assignment helpers at an economical price who write your finance and accounting assignment in proper manners.