- CSY3062 Cyber Security and Applied Cryptography Assessment Brief 2026

- COM4006 Introduction to Academic Skills and Professional Development Assessment Brief 2026

- DSM030 Statistics and Statistical Data Mining Assignment Brief 2026 | UOL

- Unit 5 Understand the Role of the Social Care Worker Assessment Question 2026

- Leading and Managing Change Assessment 1 2026 | University of Greenwich

- 6F7V0020 Biodiversity, Natural Capital and Ecosystem Services Summative In-Course Assessment Briefing 2026

- BTEC HND Level 5 Unit 4 The Hospitality Business Toolkit Assignment Brief 2026

- BTEC Level 3 Unit 2 Working in Health and Social Care Assigment 2026

- BTEC Level 1-2 Unit 20 Building a Personal Computer Internal Assessment 2026

- BTEC Level 2 Unit 11 Computer Networks Assignment Brief 2026 | Pearson

- BTEC Level 4/5 Unit 06 Construction Information Assignment Brief 2026

- BA601 Management Control Qualifi Level 6 Assessment Brief 2026 | UEL

- MLA603 Maritime Regulation and Governance Assessment Brief 2026 | MLA College

- Introduction to Organizational Behavior Assessment Critical Essay | NTU

- ILM Level 4 Unit 416 Solving Problems by Making Effective Decisions in the Workplace Assignment

- NURS08059 Resilience in Healthcare Assignment Guide 2026 | UWS

- ILM Level 4 Unit 409 Managing Personal Development Assignment 2026

- BTEC Level 3 Unit 1 Axborot Texnologiyalari Tizimlari Assignment Brief 2026

- NI523 Approaches to Nursing Adults with Long Term Conditions Assignment Workbook 2026 | UOB

- GBEN5004 Social Entrepreneurship Assignment Brief 2026 | Oxford Brookes University

CMSE11101: An investor has collated nine returns from their portfolio andCalculate the following for each asset class: Advanced Management Accounting Assignment, TUE, UK

| University | The University of Edinburgh (TUE) |

| Subject | CMSE11101: Advanced Management Accounting |

Question 1.

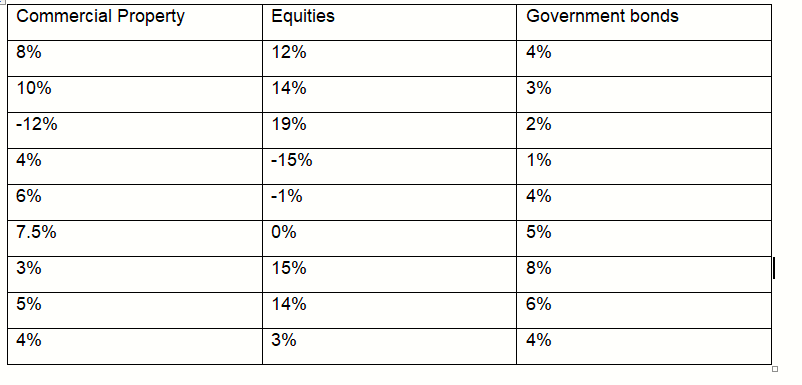

a) An investor has collated nine returns from their portfolio. Calculate the following for each asset class; mean, median, mode, variance, and standard deviation. Show your workings and briefly comment on your results

Table 1. Returns in 2022 for Commercial Property, Equities, and Government Bonds

Q1b) Using the information in Table 1, calculate the correlation between Equities and Commercial properties. Comment on the implications of your correlation calculation if you wanted to diversify a portfolio that contained both 50% weight in commercial property and 50% inequities.

Question 2.

Describe and explain how a company can manage working capital? Provide the equation that is used to calculate the net working capital and why it is useful for a company to calculate net working capital? Please give one real-world example of a company managing its working capital.

Question 3.

Critically evaluate the advantages and disadvantages of the Value at Risk (VaR) risk measurement? Then, compare and contrast the marginal VAR (M-VaR), incremental VaR (I-VAR), and the Component Var (C-VaR).

Question 4.

Describe the concept of arbitrage, and provide an example of when a company has conducted arbitrage in the past.

Question 5.

Consider a stock currently trading at $50. The periodically compounded interest rate is 3%. Suppose that U = 1.3, and D = 0.8. Calculate the value of a two-period European-style put option on the stock that has an exercise price of $50. Also, determine if early exercise would make economic sense.

Are You Looking for Answer of This Assignment or Essay

If you are looking for someone to pay for college assignments, then you have come to the right place. StudentsassignmentHelp.co.uk has a bunch of experienced and skilled writers to ensure that written solutions for accounting assignments will be 100% plagiarism free as per university standards.