- CSY3062 Cyber Security and Applied Cryptography Assessment Brief 2026

- COM4006 Introduction to Academic Skills and Professional Development Assessment Brief 2026

- DSM030 Statistics and Statistical Data Mining Assignment Brief 2026 | UOL

- Unit 5 Understand the Role of the Social Care Worker Assessment Question 2026

- Leading and Managing Change Assessment 1 2026 | University of Greenwich

- 6F7V0020 Biodiversity, Natural Capital and Ecosystem Services Summative In-Course Assessment Briefing 2026

- BTEC HND Level 5 Unit 4 The Hospitality Business Toolkit Assignment Brief 2026

- BTEC Level 3 Unit 2 Working in Health and Social Care Assigment 2026

- BTEC Level 1-2 Unit 20 Building a Personal Computer Internal Assessment 2026

- BTEC Level 2 Unit 11 Computer Networks Assignment Brief 2026 | Pearson

- BTEC Level 4/5 Unit 06 Construction Information Assignment Brief 2026

- BA601 Management Control Qualifi Level 6 Assessment Brief 2026 | UEL

- MLA603 Maritime Regulation and Governance Assessment Brief 2026 | MLA College

- Introduction to Organizational Behavior Assessment Critical Essay | NTU

- ILM Level 4 Unit 416 Solving Problems by Making Effective Decisions in the Workplace Assignment

- NURS08059 Resilience in Healthcare Assignment Guide 2026 | UWS

- ILM Level 4 Unit 409 Managing Personal Development Assignment 2026

- BTEC Level 3 Unit 1 Axborot Texnologiyalari Tizimlari Assignment Brief 2026

- NI523 Approaches to Nursing Adults with Long Term Conditions Assignment Workbook 2026 | UOB

- GBEN5004 Social Entrepreneurship Assignment Brief 2026 | Oxford Brookes University

CA6060 An airline wants to buy an aircraft and has narrowed down investment options to two alternative aircraft types: aviation Assignment, LMU, UK

| University | London Metropolitan University (LMU) |

| Subject | CA6060 FINANCIAL DECISION MAKING(In context for Aviation |

Overview and Task

CA6060 ASSIGNMENT 2

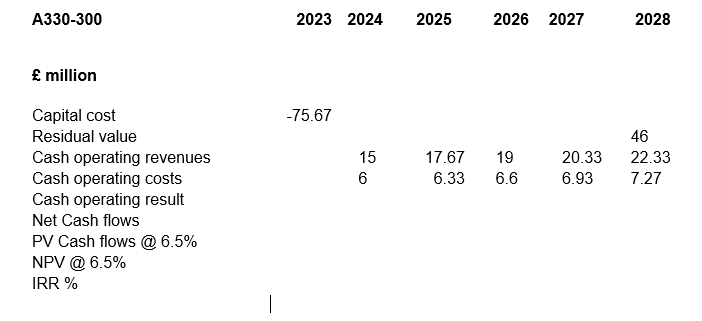

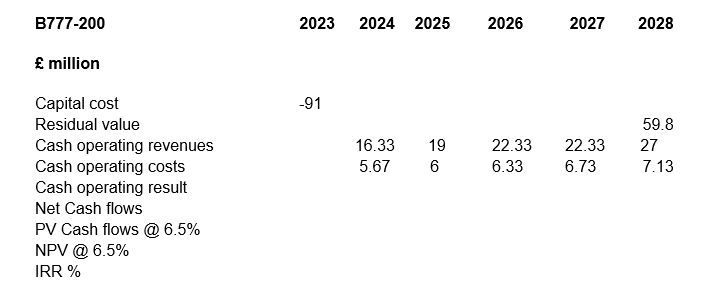

Q1. An airline wants to buy an aircraft and has narrowed down investment options to two alternative aircraft types: the acquisition of a new A330-300 for £75.67m versus a new Boeing 777-200 for £91m. The aircraft have got similar passenger capacity and each will perform the required services between specified or likely future city pairs. Where there is a difference in payload or cargo capacity, this will be reflected in the revenue forecasts.

Are You Looking for Answer of This Assignment or Essay

TASK:

- Complete the investment appraisal cash flow above (NPV, IRR e.t.c)

- b) Calculate the payback period for each aircraft (4 marks)

- c) Calculate the profitability index (please include formula and working). What are the advantages and disadvantages oF using this measure as an appraisal tool?

- d) Draw a graph of NPV against discount rate for rates between 0 to 16% (in steps of 2 i.e. 0,2,4 etc.)

- Using the above information and any other characteristics of these aircraft, which aircraft would you advise the airline to buy and why if the cost of capital is not expected to go over 10%? You should explain with the help of a sensitivity analysis.

- An airport is considering investing in a machine, which, will cost £9000 and will generate positive cash flows over the next four years as follows:

| Year | T1 | T2 | T3 | T4 |

| Cash flow(£) | 1200 | 2300 | 3400 | 4600 |

You can depreciate the asset using a straight-line method.

- Work out the annual accounting profits and then the average ROCE (Return on capital employed) to 1d.p.

- What are the advantages and disadvantages of using ROCE as an appraisal method?

- No matter which method of appraisal is applied, the users must be aware of its strengths as well as its shortcomings.

- Discuss this statement using IRR and payback period as examples.

Do You Need Assignment of This Question

In search of online assignment help UK or the finest Finance Assignment Help UK? Our service is finely tuned to aid students at London Metropolitan University (LMU), specifically focusing on subjects like CA6060 FINANCIAL DECISION MAKING (In context for Aviation).

Students can conveniently pay our experts for valuable guidance in their coursework. Whether it’s the evaluation of investment options for an airline’s aircraft purchase or delving into the intricacies of the aviation assignment, our support ensures that LMU students thrive in their Aviation Assignments.