- OTHM Level 5 Unit H/650/1142 Professional Supervision Assignment: Health & Social Care Case for Managing Supervision and Performance

- ATHE Level 4 Unit 15 Software Testing Frameworks Assignment: TDD and BDD Strategy for Medical Data Validation Script in Python

- ATHE Level 4 Unit 12 Web Design and Programming Assignment: CTO Birdwatching App Development for Urban Wildlife Insights

- ATHE Level 4 Unit 21 Synoptic Computing Project Assignment: Smart Parking App Design for Urban Mobility Solution

- ATHE Level 4 Unit 1 IT Systems Development Assignment: The World of Art Case Study for Global Online Sales Expansion

- CYP6032 Leading Multi-Agency Health & Social Care Assignment: Vulnerable Groups Literature Review and Reflective Evaluation

- Unit 21 – L/618/8101 Geotechnical Design Assignment 1: Scunthorpe Station Overpass & Bridge Infrastructure Proposal

- Y/616/7445 Unit 039 Diabetes Awareness Assignment: Understanding, Managing and Supporting Individuals with Diabetes

- DHCS 12 (M/650/5189) Understand Mental Ill Health Assignment: Explore DSM/ICD Disorders, Discrimination & Capacity

- Unit 8 Social Media Strategy Assignment 2: Planning, Execution & Evaluation for Organisational Growth

- CIPD Level 7CO01 Strategic People Management Assignment: Demographic Trends, Legal Reforms, Innovation & Resilience in the Workplace

- Financial Accounting Assignment: Lee’s Sole Trader Transactions & Cash Flow Analysis

- L/508/4603 NCFE Level 3 Sport and Exercise Massage Assignment 3: Consultation & Technique Review for Two Contrasting Athletes

- F/650/1141 Unit 4 Team Management and Recruitment Assignment: Health & Social Care Case Study for Effective Leadership and PDPA-Compliant Hiring

- R/650/1138 OTHM Level 5 Assignment: Working in Partnership in Health and Social Care

- NVQ Level 3 Health and Safety Risk Management Assignment: Practical Assessment and Workplace Application

- MBA7068 Strategic Portfolio Assignment 1: Global Business Trends and Managerial Skill Development

- Mechanical Services Innovation: Hotel Rotation Case Study for Energy-Efficient Heat Pump Integration

- K/618/4170 ATHE Level 3 Unit 4 Assignment: Working in Health and Social Care

- T/618/4169 ATHE Level 3 Unit 3 Assignment: Human Growth and Development in Health and Social Care

BA30592E: David Green is going to set up a sole trader business as a Decorator He knows that he would be personally responsible for his business’s debts: Recording Business Transaction Assignment, UOWL, UK

| University | University of West London (UoWL) |

| Subject | BA30592E: Recording Business Transactions |

- Learning outcomes

Part A

- David Green is going to set up a sole trader business as a Decorator. He knows that he would be personally responsible for his business’s debts. He also would have some accounting responsibilities; however, he does not know about the steps for starting a business. As your area of studying is related to Business, he wants you to consult him in this matter.

- Accounting involves recording, analyzing, and summarising the transactions of an entity to provide information for decision making.

Part B

- F Polk, after being in the Bakery business for some years without keeping proper records, now decides to keep a double-entry set of books. On 1 September 2021 he establishes that his assets and liabilities are as follows: Assets: Van £5,700, Fixtures £2,800, Stock £5,200, Debtors – P Mullen £105, M Abel £311, Bank £1060, Cash £85. Liabilities: Creditors – Syme Ltd £229, A Hill £80.

He is not sure about Journal entries for the following transactions in September 2021 as follows:

- Sep 1: A debt of £105 owing from P Mullen was written off as a bad debt

- Sep 5: Office Fixtures originally bought by credit for £150 was returned to the supplier Syme Ltd., as it was unsuitable. The full allowance will be given for this.

Recording Business Transactions BA30592E - Step 10: The business is owed £311 by M. Abel. He is declared bankrupt and we only received £180 cash in full settlement of the debt.

- Sep 18: Bought a Machinery from Brown Ltd. to use in the company. The total purchasing value of the machine is £1,800. The owner paid £100 cash, £500 by issuing a cheque, and the rest of the purchasing value would remain as credit.

- Sep 26 The owner paid half of the machinery debt to Brown Ltd. by issuing a cheque.

- Sep 28: The owner paid £130 an insurance bill via cheque thinking that it was in respect of the business. We now discover that £70 of the amount paid was in fact insurance of our private house.

Do You Need Assignment of This Question

- On 1 August 2021, the owners of the ABC Enterprise, Maurice & brothers, decided that they will boldly go and keep their records on a double-entry system. Their assets and liabilities at that date were. Their assets and liabilities at that date were: office fixtures £1200, a van £32,000, and £36,800 in the bank account. They have no liabilities at the 1st of August 2021

Their transactions during August 2021 were as follows

- Aug 2 Maurice & brothers received a loan of £12,400 from Santander Bank and they deposited it in their bank account.

- Aug 3 The amount of £2800 was transferred from the Bank Account to the Cash and hand account.

- Aug 4 Bought a second-hand Van paying by cheque £6,200

- Aug 5 Bought office fixtures £3400 from Sharp Office Ltd. They paid £1000 by issuing a cheque and the rest of the value of the fixtures would remain as credit.

- Aug 8 Bought a new van on credit from Toyota Co. £8,700

- Aug 15 Bought office fixtures paying by cash £110

- Aug 19 Paid Toyota Co. a cheque for the whole amount of debt

- Aug 25 Paid £430 of the cash in hand into the bank account

- Aug 28 Bought new office fixtures paying via bank account £750

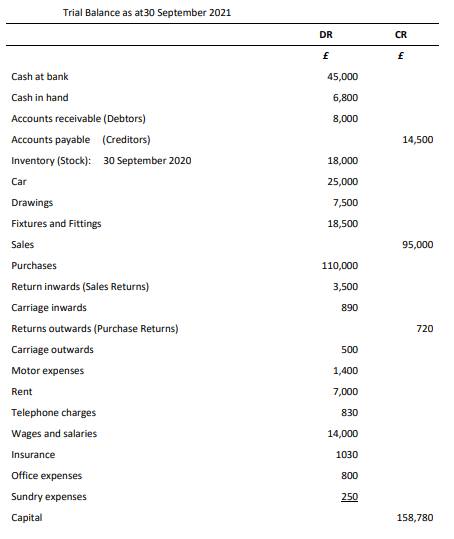

- Then balance off the accounts and extract a trial balance for sole trader B Moore. as of 30 September 2021:

Buy Answer of This Assessment & Raise Your Grades

Are you Searching for online accounting assignment help? Yes, we can provide online assignment help services in UK. We have a team of professional assignment helpers who can provide solutions to your Recording Business Transactions assignment at a pocket-friendly and this solution will be 100% Plagiarism-Free.

Answer