- OTHM Level 5 Unit H/650/1142 Professional Supervision Assignment: Health & Social Care Case for Managing Supervision and Performance

- ATHE Level 4 Unit 15 Software Testing Frameworks Assignment: TDD and BDD Strategy for Medical Data Validation Script in Python

- ATHE Level 4 Unit 12 Web Design and Programming Assignment: CTO Birdwatching App Development for Urban Wildlife Insights

- ATHE Level 4 Unit 21 Synoptic Computing Project Assignment: Smart Parking App Design for Urban Mobility Solution

- ATHE Level 4 Unit 1 IT Systems Development Assignment: The World of Art Case Study for Global Online Sales Expansion

- CYP6032 Leading Multi-Agency Health & Social Care Assignment: Vulnerable Groups Literature Review and Reflective Evaluation

- Unit 21 – L/618/8101 Geotechnical Design Assignment 1: Scunthorpe Station Overpass & Bridge Infrastructure Proposal

- Y/616/7445 Unit 039 Diabetes Awareness Assignment: Understanding, Managing and Supporting Individuals with Diabetes

- DHCS 12 (M/650/5189) Understand Mental Ill Health Assignment: Explore DSM/ICD Disorders, Discrimination & Capacity

- Unit 8 Social Media Strategy Assignment 2: Planning, Execution & Evaluation for Organisational Growth

- CIPD Level 7CO01 Strategic People Management Assignment: Demographic Trends, Legal Reforms, Innovation & Resilience in the Workplace

- Financial Accounting Assignment: Lee’s Sole Trader Transactions & Cash Flow Analysis

- L/508/4603 NCFE Level 3 Sport and Exercise Massage Assignment 3: Consultation & Technique Review for Two Contrasting Athletes

- F/650/1141 Unit 4 Team Management and Recruitment Assignment: Health & Social Care Case Study for Effective Leadership and PDPA-Compliant Hiring

- R/650/1138 OTHM Level 5 Assignment: Working in Partnership in Health and Social Care

- NVQ Level 3 Health and Safety Risk Management Assignment: Practical Assessment and Workplace Application

- MBA7068 Strategic Portfolio Assignment 1: Global Business Trends and Managerial Skill Development

- Mechanical Services Innovation: Hotel Rotation Case Study for Energy-Efficient Heat Pump Integration

- K/618/4170 ATHE Level 3 Unit 4 Assignment: Working in Health and Social Care

- T/618/4169 ATHE Level 3 Unit 3 Assignment: Human Growth and Development in Health and Social Care

ACFI3422: Keener Ltd is a UK company that manufactures water bottles, it is one of the largest suppliers of these water bottles in the UK today: Liquidity and Risk Assignment, DMU, UK

| University | De Montfort University (DMU) |

| Subject | ACFI3422: Liquidity and Risk |

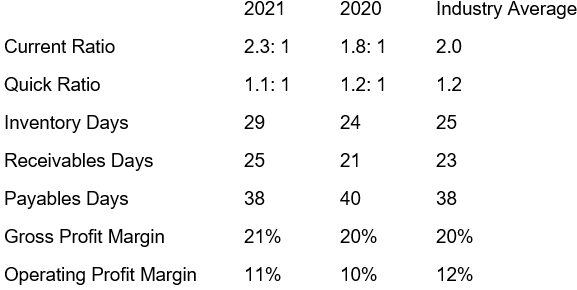

Keener Ltd is a UK company that manufactures water bottles, it is one of the largest suppliers of these water bottles in the UK today. It has a year-end of 30th of November. The liquidity ratios have been calculated for the previous 2 years: –

Keener has forecast the following for the year ended 30th of November 2022:

Credit management

Sales to increase to £8 million for the year to come.

Receivables are forecast to be £1,150,000.

The cost of financing receivables is covered by an overdraft at the interest rate of 5% p.a.

Keener is now considering offering a cash discount of 0.5% for payment of debts within 20 days. It is expected that 25% of customers will take up the discount.

Inventory management

Keener is also trying to find the optimum order quantity for its inventory. The monthly demand for its inventory which costs £2.30 per unit is 80,000 units per month. The cost per order is currently £1.25. The holding cost of 1 unit p.a. is £1.

Keener’s suppliers have offered a discount of 0.5% per unit for orders of 2,000 units or more.

Do You Need Assignment of This Question

Cash management

Keener has a constant demand for cash totaling £5,000,000 p.a. It can replenish its current account by selling a constant amount of gilts which are held as an investment earning 3% p.a. The cost per sale of gilts is a fixed £8 per sale.

The management of Keener has also considered using the Miller-Orr model of cash management. They have considered a lower limit of £1,000,000, the standard deviation of the daily cash flows is £40,000 and it will cost £12 per transaction to transfer money to or from the bank. The interest rate is 3% p.a.

Unseen material

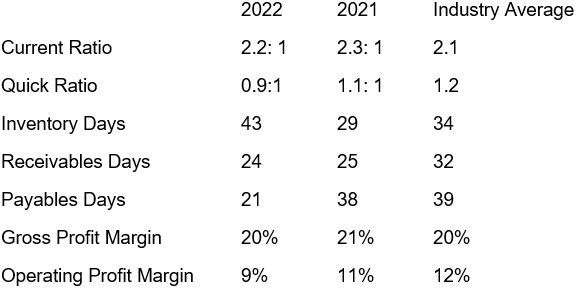

Keener has forecast the following for the year ended, 30th of November 2023:

Credit management

Sales are forecast to be £8.85m for the year ahead.

Receivables are forecast to be £1,010,000.

The cost of financing receivables remains the same.

Inventory management

Monthly demand for its inventory remains the same but the cost has increased to £2.65 per unit. The cost per order has increased to £1.48. The storage cost of 1 unit p.a. is £0.55.

Cash management

All details remain the same, except the annual demand for cash is now £6,350,000.

Are You Looking for Answer of This Assignment or Essay

Tasks for evaluation

The managers of Keener want you to evaluate the company’s liquidity position. To help you to do this, consider the following:

Section A – Calculations

Calculate the following: –

- The benefit (or otherwise) of offering a discount of 0.23% for payment of the debt within 16 days. Take up for this discount is predicted to be 27%.

- The optimum quantity of inventory to order is if the suppliers now offer a discount of 0.30% per unit for orders of 2,600 units or more. Keener’s Cost of Capital is 17%.

- The lower limit, upper limit, and return point (from the Miller-Orr model) for Keener if the standard deviation of cash flows is £42,000 per day and briefly explain how this approach works.

Section B – Evaluation

- Using the working capital ratios for 2021 and 2022 critically evaluate the liquidity position of Keener.

- If Keener was facing a cash flow problem, critically evaluate whether they should enter a factoring arrangement, instead of offering an early payment discount.

- Explain how the one-bin and two-bin systems work and evaluate the advantages and disadvantages of each system.

In places where diagrams would assist your answer, they should be used. Any words used to label the diagrams are excluded from the word count.

Do You Need Assignment of This Question

Are You Looking for UK Assignment Help? We’ll assist you with, UK No. 1 assignment services at the most affordable price. Just request us “do my assignment cheap” and we’ll provide you with the best assignment help for you.