- SWE4202 Computing Infrastructure Assignment 1 and 2 Brief 2026 | University of Bolton

- ITAO7104 Data-Driven Decision-Making Assignment Brief 2026 | QUB

- ED3606 Education and Research 3 – Dissertation Brief 2026 | Brunel University of London

- Qualifi Level 6 BA602 Management of Salesforce Assessment Brief 2026

- MLA603 Maritime Regulation & Governance Assignment Information 2026 | MLA College

- ILM Unit 507 Understanding the Organisational Environment Assessment 2026

- Advanced Management Accounting Assessment Information 2026 | University of Salford

- GEOG20091 Sustainability Formative Assessment Brief 2026 | Nottingham Trent University

- 6BM500 Business Psychology Assessment Brief 2026 | University of Derby

- MS1S463 Problem Solving for Computing Assessment Brief 2026 | USW

- HWSC5005 Applied Research in Practice Assignment Brief 2026 | OBU

- Qualifi Level 7 Unit 724 Development as a Strategic Manager Assignment Brief 2026

- A6001C17 Advances in Animal Production Science Assignment Brief 2026 | HAU

- SOCI5270 Contemporary Sociological Theory Essay Assessment 2026 | UOK

- 4BE002 The Innovative Business Assignment Brief 2026 | University of Wolverhampton

- CIPD Level 5 5LD01 Support Informal and Self-Directed Learning Assessment Brief 2026

- COM4016 Productivity and Collaboration Tools for Learning and Work Assessment Brief 2026 | Arden University

- CA6060 Financial Decision-Making in Context for Aviation Assignment 2 Question 2026

- NCFE CACHE Level 3 Diploma for Working in the Early Years Sector Assessment Brief 2026

- CRN 63466 / CRN 63467 Statutory Valuation Level 7 Assessment Brief 2026 | USM

6008LBSBSC: UK Oil Plc is involved in upstream, oil exploration and production in the North Sea, United Kingdom: Strategic Corporate and Project Finance Assignment, LJMU, UK

| University | Liverpool John Moores University (LJMU) |

| Subject | 6008LBSBSC: Strategic Corporate and Project Finance |

Company Background

UK Oil Plc is involved in upstream, oil exploration and production in the North Sea, United Kingdom.

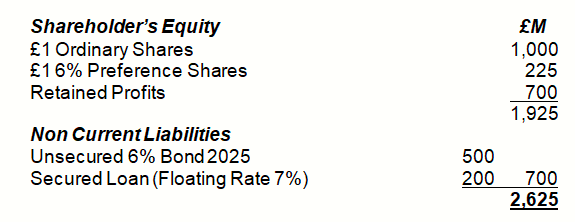

Their current finance structure is detailed below:

Last year’s Profit Before Tax was £500Mand this level of profit is expected to continue from existing business, at least in the short term.

Ordinary shareholders have previously received the following dividends:

- 3 years ago – 5%

- 2 years ago – 6%

- 1 year ago – 6.5%

Current Market Price Per Ordinary Share: £3.50

Future Strategy

The Board of UK Oil is considering its future strategy.

Despite the challenges facing the sector, (declining UK oil reserves, volatile oil prices, pressure from US shale producers, volatile demand, coupled with a high-cost base and environmental risks), the Board feel they must invest in order to grow the business.

The Board is willing to invest up to £350 million and requires your evaluation of the following potential Project, together with evidence-based, justified recommendations:

The Development & Operation of a New Oil Reservoir in the North Sea

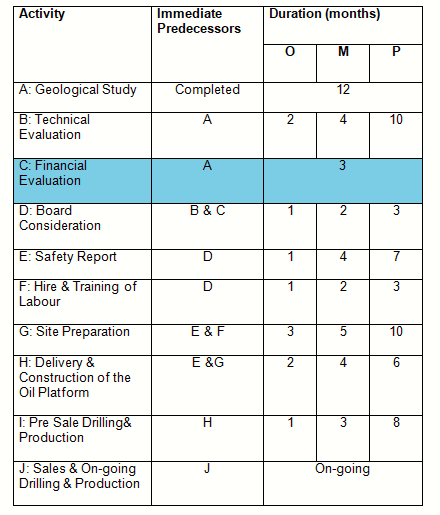

Activity A: Geological Studies

Geological studies lasting 12 months have just been completed at a cost of £20 million.

Seismic and geological studies have cast doubt on the amount and quality of oil available for extraction, i.e.it may not provide 8,000,000 barrels per annum for 25 years as initially thought.

- Undertake the investment immediately in the hope that the amount and quality of oil are available. However completed studies estimate that there is only a 35 chance that the amount and quality of oil suggested, is available for extraction.

- Carry out Further Tests(which would delay the Board’s decision by 1 year and cost $50M) and then decide whether or not to drill. The estimated probability of the test yielding positive results is 0.30, in which case there would be a 70 probability of success. If the tests are negative there is then only a 0.20 chance of success.

This may also give time to form a Strategic Alliance with a partner(operational and/or financial), to share cost, risks and know-how. The form of Strategic Alliance has yet to be decided.

- Sell the Drilling Rights to a third party (another oil company):

- either immediately, for US$ 45 million, or

- after the Further Tests, (together with the Test Results) for:

- US$140 (assuming the tests were positive), or

- US$ 20 (if the tests prove negative)

The project is now entering the Technical & Financial Evaluation Stage, Activities B & C

Activity B: Technical Evaluation

Production & Chemical Engineers will be asked to evaluate the feasibility of the project over the next 3 months

Activity C: Financial Evaluation

Your task is to present a Financial Evaluation & Recommendations to the Board in 3 months’ time to assist in their decision-making. In this respect you should base your initial assessment on 8,000,000 barrels per annum for 25 years.

Activity D: Board Consideration

The Board will consider both the Technical & Financial Evaluations before making their decision whether or not to proceed with the project.

Should the Board decide to proceed the Project will move on to Activities E through to J as detailed below

Activity E: Safety Report

A shortage of safety engineers in the sector may well prove critical to the timely start of the project, though this could be solved by moving suitably qualified staff from other activities, though it is uncertain whether this action would then delay the project.

Activity F: Hire & Training of Labour

Activity G: Site Preparation

Associated costs of Activities F & G are included in “Other Costs” detailed below

Activity H: Delivery & Construction of the Oil Platform including Drills, Pumps, Pipelines, etc

Two suppliers have been identified, British Oil Machinery which has quoted £315,000,000, and Munchen Machinery Germany which has quoted €350,000,000.

CAPEX will of course be eligible for any Tax Allowances.

Details of the contract have yet to be agreed but UK Oil will clearly need to reduce the risks associated with the tender and performance of the contract, particularly as both contractors may require an advanced payment of 10%.

Do You Need Assignment of This Question

hire online assignment writer UK on 6008LBSBSC: Strategic Corporate and Project Finance. our experts are highly educated to provide the well researched solution on finance assignment as per university guideline at a most reasonable price.