- 7BIOM037W Systems Biology Coursework 1 Report 2026 | University of Westminster

- NCFE CACHE Level 3 Unit 8 Professional Practice Portfolio 1 Coursework 2026

- NCFE CACHE Level 3 Unit 9 Supporting Emergent literacy Coursework 2026

- 6WBS0035/ 6WBS0036 Digital Economy CW1 Assignment Brief 2026 | UOH

- DSM060 Data Science Research Topics Coursework Assignment 2026 | UOL

- BARC0087 Structures Materials & Forming Techniques Coursework 2026 | UCL

- LL5306 Commercial Law Assessment Coursework Brief 2026 | Kingston University

- M22319 / M33098 Numerical Skills & Economics Assessment Coursework | UOP

- BMG872 Global Strategy Development and Implementation Individual Assignment CWK Brief 2026

- LLB020N204A Law of Property Assessment Coursework Brief 2026

- BS3397 Microeconometrics Coursework Assignment Brief 2026 | AU

- UMAD47-15-M Managing Finance Assessment Coursework Brief | UWE

- BST851 Business Data Analytics Assessment Coursework 2026

- MMM143 International Business and the World Economy Coursework 2026

- EMS402U Engineering Design Coursework Project Report 2026 | QMUL

- 25BSC565 Fundamentals of Strategic Management Coursework Brief

- MARK5025 Contemporary Marketing Communications Assessment Coursework Brief 2

- GEEN1127 Design and Materials Individual Coursework Brief 2025-2026 | UOG

- BPS319 PBL 3 Natural Product Chemistry vs Kinetic Isotope Effects Coursework | UOL

- LD7098 Cyber Security Principles Coursework Assessment 2025-26 | Northumbria University

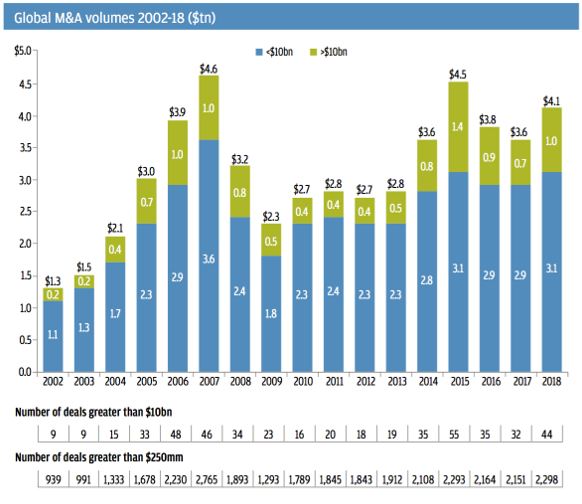

The global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year: Corporate Finance Coursework, QMUL, UK

| University | Queen Mary University of London (QMUL) |

| Subject | Corporate Finance |

The global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year ever for M&A; volumes. The announced volume in the first half of 2018 was robust, representing the second-highest first half of all time. The activity was largely driven by “megadeals”.

Thirty megadeals were announced in the first six months of 2018 — the highest first-half megadeal count on record — compared with 14 deals in the first half of 2017. The number of megadeals began to normalize throughout the second half of the year, although they continued to be a significant driver of activity in 2018.

While megadeals were a large driver of M& A-announced dollar volumes in 2018, the count for deals greater than $250 million also increased by 7% from 2017, with activity remaining robust across all deal types. The activity was brisk across domestic and international deals, strategic and private equity, and all sectors, with technology and healthcare representing the largest contributors to global volume in 2018. Private equity funds continued to have ample “dry powder” and deployed this capital throughout 2018; sponsor buy-side volume was up 9% YOY.

Several of the key drivers and catalysts of M&A; A have continued from prior years. Positive global growth, improving cash flows, strengthening balance sheets, low cost of debt, investor support, and CEO confidence all continued to boost M&A; activity. The biggest new tailwind this year was the implementation of tax reform in the U.S., which helped generate incremental cash flows and provided access to overseas funds.

Innovation, disruption, and the need for growth also contributed to M&A activity, driving change across industries, geographies, and organizations. An accelerating rate of disruption has driven the need to act with urgency. As a result, new consumption patterns, new platforms, and new business models are resetting the basis of competition, redistributing industry economics, and reallocating value. We’ve seen a drastic increase in the technology sector over the past decade, more than doubling its share of the overall M&A market as the sector continues to innovate to meet changing demands.

While geopolitical uncertainty was prominent throughout the year and created many headlines, it had a limited effect on deal volumes in the first half of the year but may have contributed to the deceleration of activity toward the end of 2018. Meanwhile, cross-border M&A volume remained strong, accounting for 30% of the total M&A market, but with a different mix: China’s outbound M&A continued to decline, while Japan’s outbound M&A was robust throughout the year, with a record $184 billion in announced volume and a record number of deals larger than $1 billion. However, Japan’s activity benefitted disproportionately from Takeda Pharmaceutical’s acquisition of Shire for $81 billion.

Are You Looking for Answer of This Assignment or Essay

At Students Assignment Help UK, we provide university assignment help to students who are struggling with their assignments. We know how important your university assignments are, and we are committed to providing you with the high-quality assignment help that will get you the grades you need. Contact us today to learn more about our university assignment help services.